Writer, Trader, Musician, Entrepreneur, Educator

I'm Jared, and I help people take control of their personal debt, finances, and investment goals.

Contrary to what you might expect from a finance guy, I talk about how not to be an idiot with your money, and how your life and finances can be a lot better by getting a few things right.

When it comes to investing, people subscribe to me because they know they’re getting a fresh, straightforward, and unconventional look at the markets.

Here are just a few reasons people subscribe:

They want to build a resilient and profitable core portfolio, with the ability to handle market ups and downs in good times and bad.

They want no-nonsense contrarian market analysis that bucks the crowd, and they’re hungry for an aggressive stock-picking service.

They’re financial professionals or sophisticated investors who want a thorough, daily analysis of the markets and investor sentiment.

They want to get their personal finances in order, and then tackle investing.

The first financial book I ever read was A Random Walk Down Wall Street at age 23. I said, “This is the dumbest book I have ever read,” and set out to prove it wrong.

—Jared Dillian

I’m from Norwich, a town of about 35,000 on the intersection of three rivers in economically depressed eastern Connecticut.

We didn't have a lot of money, so going to the Crystal Mall down the road in Waterford was considered an adventure.

My parents divorced when I was seven. I was raised by my grandmother until I was 14.

I went to Norwich Free Academy (NFA), known for its incredible arts and music program, which had a profound effect on my life.

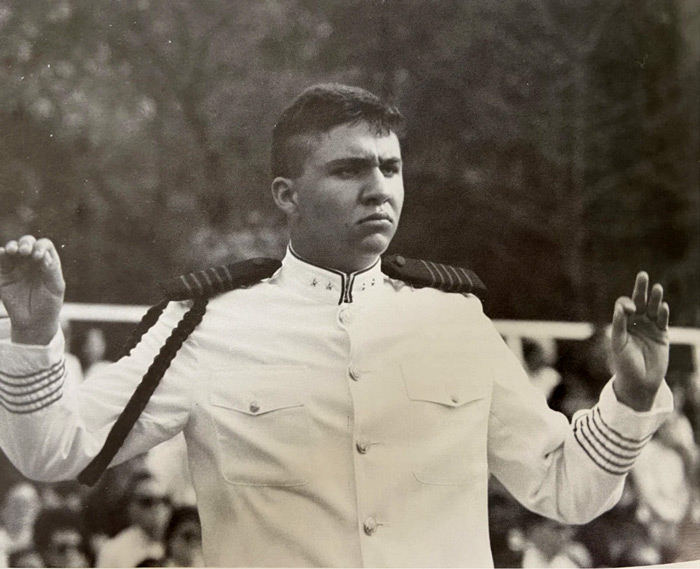

I was a drum major and won a few awards.

Honestly, if it weren’t for Band Director John Kuhner, I’m not sure where I’d be today.

It was there that I learned discipline, composure, patience, and focus...

Basically, all of the characteristics required to be a successful trader.

I went to the Coast Guard Academy and served as a commissioned officer.

I was a Drum Major there too, my senior year, after spending three years playing in the drumline.

After I graduated, I was enforcing fisheries regulations off the coast of Washington and Oregon, but at times running counterdrug patrols off the coast of Mexico.

From there, I became a spy. Really. I worked in Coast Guard Intelligence in support of fisheries enforcement for three years.

At age 23, I stumbled upon the first financial book I ever read, A Random Walk Down Wall Street.

I said, “This is the dumbest book I have ever read,” and set out to prove it wrong.

I decided to go to business school part time at the University of San Francisco.

But I needed some real-world experience.

Luckily, I got hired on the Pacific Coast Options Exchange as a clerk, which basically meant I ran tickets around and got the traders lunch. But I learned a lot about options and the markets.

This was in 1999–2000, back when there were exchanges and paper tickets. Talk about old school.

Mind you, I was still full time in the Coast Guard.

I was working a full-time job as a lieutenant in the Coast Guard, going to grad school part time, and I had a part-time job on the floor of the Pacific Options Exchange.

My typical day was this: I’d get up at 3:45 am to drive to San Francisco for my trading floor job, I’d work there until about noon, and then I’d head back to my Coast Guard job to work from 1 pm until 10 pm.

I’d come home and study until one or two in the morning.

Then I’d go to bed and do it all over again.

Sounds like a lot, and it was, but this kind of hustle gave me a huge edge over people when I was applying for jobs on Wall Street.

I exploited every single contact I had, set up informational interviews in New York, and made several trips out East for meetings.

Not all of these meetings were successful.

But I was onto something.

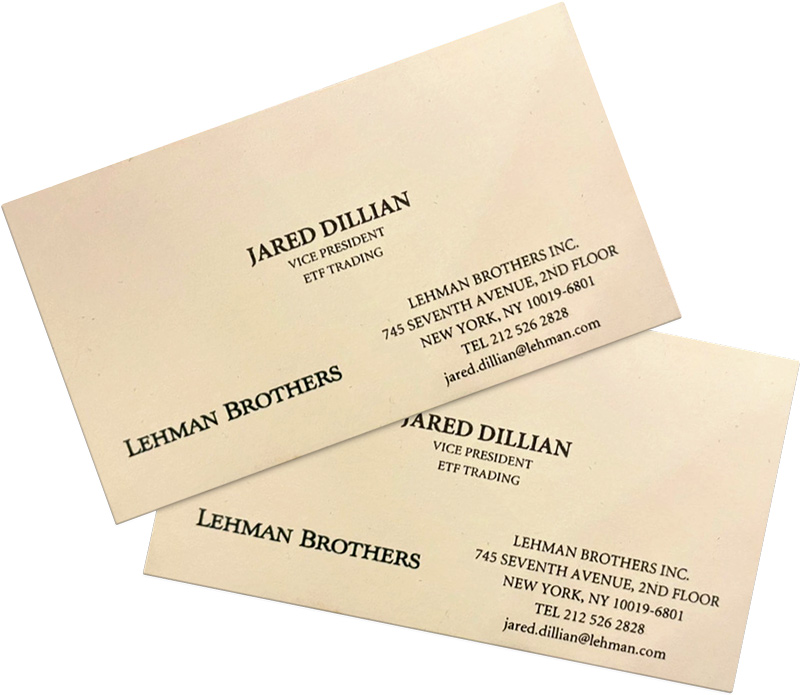

The guys at Lehman liked the idea of a scrappy Coast Guard guy becoming a trader.

I could sit in interviews on the trading floor and talk about options and trading in a way that someone from an Ivy League school could not.

Though I didn’t have an educational “pedigree,” I had what others didn’t: an unstoppable work ethic and perseverance.

Lehman hired me first as an index arbitrage trader, where I accounted for as much as 10% of daily volume in NDX futures and 17% in midcap futures.

Then I got promoted to head of the ETF trading desk where I raised top-line revenue (commissions) from $32 million in 2004 to $82 million (annualized) in 2008.

But it wasn’t all sunshine; that experience took me to places I couldn’t imagine.

I can’t get into details here: If you want to read about it, pick up a copy of my first book, Street Freak: Money and Madness at Lehman Brothers.

I started writing financial commentary in 2004 for my institutional customers and ETFs.

I was trying to be witty, but it spread like wildfire: Thousands of people signed up.

It was mostly entertainment, but it had this viral quality to it, and no one else was doing it.

I was onto something.

When Lehman collapsed, I was offered a job at Barclays that would pay me seven figures.

Instead, I bet on myself and started a financial newsletter business. But it was the absolute worst time to start a financial newsletter business.

This was in the middle of the 2008 financial crisis. The first two years were awful.

I would come into the office every morning, and the first thing I would do was puke in the trash can.

But I kept at it. And guess what? Over the course of 15 years, it grew to become one of the biggest, most well-known financial publications in the world.

Today, I write books and essays, host podcasts, and frequently appear as a guest on TV.

And I just got my MFA in creative writing from Savannah College of Art and Design.

If you want to succeed, there is no limit to your success.

America is one of the few places in the world where you can drive a Ferrari down the street, and someone won’t throw a rock at it.

I’ve worked for the government, I’ve worked in big business, and I’ve worked in small business.

And I can tell you that being an entrepreneur has been the most fun—by far.

There’s nothing like creating something, building it, and being your own boss.

You take the credit for all the successes... and you take the blame for all the failures.

I hope at some point in the future, you will get an idea and that it will grow into an obsession... and then you will take the risk and bet it all on yourself.

And even if it is a failure, you will have so much fun, and you will learn lessons for the next time you decide to take a risk.

I’m also here to tell you that things won’t always be wonderful.

Life throws some curveballs at you sometimes.

Divorces. Addiction. Mental illness. Sick children. Losing your job.

I’ve been through it all. I’m a 9/11 survivor. I lived through the Lehman Brothers collapse.

I’ve been through so much trauma, and I came out the other side. Everything that has happened to me has only made me stronger.

The one gift we have is that we can choose our response to any situation.

I’ll say it again: There is no limit to how successful you can be.

If there's one thing I hope you take away from my story, it’s this: The most important decision you will ever make is what to do with the next 24 hours.

Jared Dillian, MFA

Jared Dillian is one of the industry’s most original, entertaining, contrarian voices.

He is a master of market psychology and has been called the “Dr. House” of trading, and he has a following ranging from casual investors to professional traders and hedge fund managers.

He has been a regular contributor at Bloomberg Opinion, Forbes, TheStreet.com, and other outlets.

Jared is a frequent speaker at conferences, and his appearances include MSNBC, Bloomberg TV, The New York Times, LA Times, Business Insider, and dozens of local and syndicated radio programs.

Additionally, he is a teaching associate in the business program at Coastal Carolina University.

He graduated from the United States Coast Guard Academy in 1996 with a BS in mathematics and computer science, received his MBA from the University of San Francisco in 2001, and received an MFA in 2023 from the Savannah College of Art and Design.

Jared lives in Myrtle Beach, South Carolina with his wife Carolyn and their cats Stripe, Tars, Vesper, Wendy, Xenia, and Yellow.

Jared is the author of Street Freak: Money and Madness at Lehman Brothers, which was named Businessweek’s #1 general business book of 2011, the novel All the Evil of This World (2016), Those Bastards: 69 Essays on Life, Creativity, and Meaning (2023), No Worries: How to Live a Stress-Free Financial Life (2024), and Night Moves (2024).

The Jared Dillian Letter is a free weekly letter dedicated to helping people who want a fresh and unconventional take on investing and personal finance. Readers learn how to be smarter with finances and investments through Jared’s unique takes on life, success, money, and happiness.

Jared’s free blog We’re Gonna Get Those Bastards is about the raw truth of everything that’s depraved, especially finance, culture, music, and sex. Parental discretion advised.

When Jared’s not on TV, writing, or investing, he’s performing live as DJ Stochastic.

A classically trained pianist and organist, his love for electronic music continued through adolescence and into adulthood. And after the financial crisis of 2008, he decided to (at last) pursue his dream of being a DJ.

Today, Jared regularly performs for live audiences and dance clubs. His music is a blend of progressive house and techno: masculine underground techno beats with progressive elements, both emotive and lyrical—but never commercial.