Benefit from higher rents (without buying a rental)

We’ve been talking about inflation for the past year and a half. So, I get a lot of emails from readers about ridiculous prices—like the guy who recently paid $18.50 for avocado toast.

Meanwhile, wages are going up. So, many people feel like they’re getting richer, but they are not. If your income rises 4%, and prices on the things you need rise over 6%, your standard of living is going to drop.

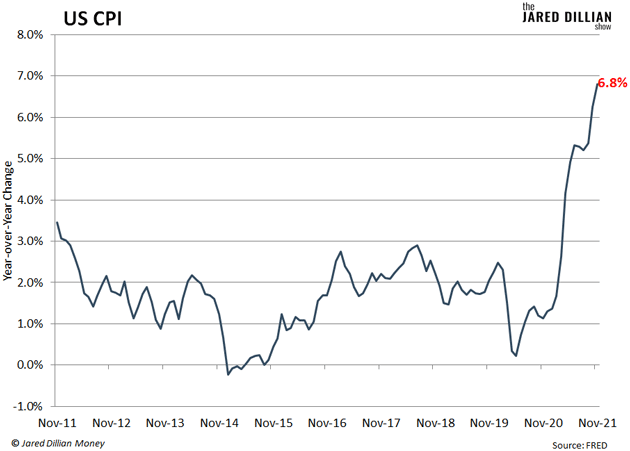

And that is exactly what’s happening… the CPI jumped 6.8% last month. It was the biggest increase in 39 years. It was also the sixth month in a row that inflation was over 5%, and the second month in a row it was over 6%.

People are dealing with inflation in different ways. For the wealthy, it’s not much of a problem. They own stocks, real estate, and other assets that are shooting up in value.

For low wage earners, though, inflation is disastrous. They have no choice but to take the hit. So, they buy chicken instead of beef, wear their old shoes a little longer, drive a little less, and hope things get better someday.

-

But where does inflation leave everyone in the middle?

By that, I mean people who aren’t wealthy enough to become local land barons, but who have some money saved up, and want to get positive exposure to inflation. Well, they have options…

Finite Resources

Longtime readers know that, over time, gold is an excellent inflation hedge. You can also buy silver or invest in copper, as I mentioned last week.

Then you’ve got land, another finite resource. The specifics vary from place to place—an acre of rural farmland won’t follow the same price trajectory as an acre in Beverly Hills. But typically, property values and rents go up over time, which makes real estate another great inflation hedge.

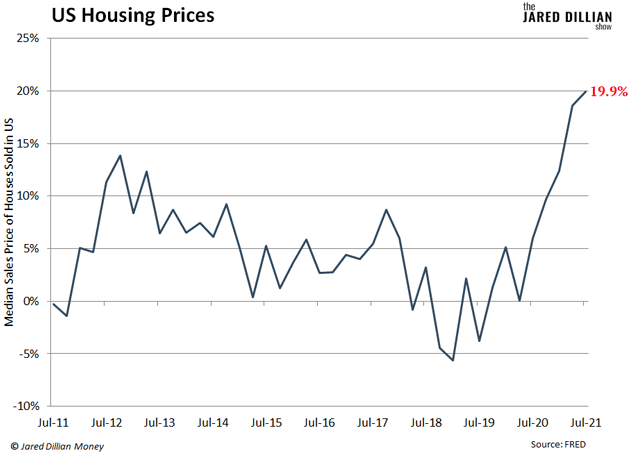

Everyone knows housing prices are soaring. As of Q3 2021, the median sale price for houses sold in the US increased 19.9% year over year to $404,700.

Home sales are on track to hit a 15-year high in 2021. And with inventory tight, it's a seller's market. That means prices will likely keep climbing.

So, how can you profit from rising real estate prices if you don’t have an extra $400,000 to scoop up a rental property? You can invest in a REIT…

My Favorite Way to Invest in Real Estate

A REIT is a special type of business entity that owns various kinds of real estate. Then it turns around and leases the space to bring in income.

REITs trade just like stocks, so you can invest in them through an ordinary brokerage account. Really, they’re a convenient, liquid way to get exposure to real estate without the hassle and commitment of actually buying and maintaining it.

You get the upside of being a landlord. But you don’t have to collect rent or field phone calls about leaky toilets at 3am. And when you want to sell, you just log in to your brokerage account and sell.

Jared Dillian

|