Big Tobacco Doesn’t Care about Your Money

Let’s say you want to invest, but you have a conscience.

You think there are good companies and bad companies. And you don’t want to invest in the bad companies, because you don’t want to support things you disagree with.

This is holding you back from investing in certain stocks and mutual funds. You can’t control what a fund manager buys, and he might invest in companies you don’t want to support.

For many people, that means the traditional “sin stocks” like alcohol and tobacco companies, plus gun companies, and now oil companies.

It’s a rosy idea. But are you really supporting those companies when you buy their stocks? The evidence points to “no.”

Virtue Signaling

Take a tobacco company like the Altria Group (MO), for example. It owns the popular Marlboro cigarette brand. Plus, it has a foothold in the e-cigarette, cannabis, and wine industries. Basically, all the stuff your doctor wants you to avoid.

If you buy 100 shares of Altria, you’re not really helping the company. For one thing, your effect as an individual investor is miniscule—you can’t really move the stock. Even if you did, you might push it up by one-tenth of a penny, at most.

How does that affect the company? Well, some executive at Altria whose compensation is tied to the stock is going to be a teeny-tiny bit richer. But your investment isn’t going to fund his new pool house or his next trip to the Maldives.

Your effect as an individual investor is negligible at most. So, the people at Altria don’t really care if you buy the stock or not.

Of course, it’s a different story if you participate in the initial public offering (IPO) of one of these companies. See, when a company “goes public,” it offers up a certain chunk of shares in an IPO. And when you buy those shares, the money actually goes to the company.

In those instances, you are supporting the company, because you’re handing it cash. But the company doesn’t get any money when you buy its stock in the secondary market—which is what individual investors generally do.

In other words, refusing to buy the stock on principle alone boils down to virtue signaling and nothing more.

The Unconstrained Investor Always Wins

There’s a name for this—it’s called ESG investing. It’s where people invest their money in companies that claim to have a positive impact on society and the environment—instead of companies that aim to do well for their shareholders.

The idea behind ESG investing makes a certain kind of person feel warm and fuzzy inside. But it’s not a great strategy if your goal is making money.

If you won’t buy gun stocks, tobacco stocks, cigarette stocks, and the like, then you’re a constrained investor. There are limits, or constraints, on what you will buy.

Compare that to the investor who is willing to buy anything, no matter how yucky the company’s underlying business makes him feel. That guy is an unconstrained investor.

In the end, the unconstrained investor always wins.

Think about it—how could you reasonably expect someone who has constraints to outperform someone who doesn’t? You can’t. And this is borne out in the market.

Let’s circle back to tobacco stocks again.

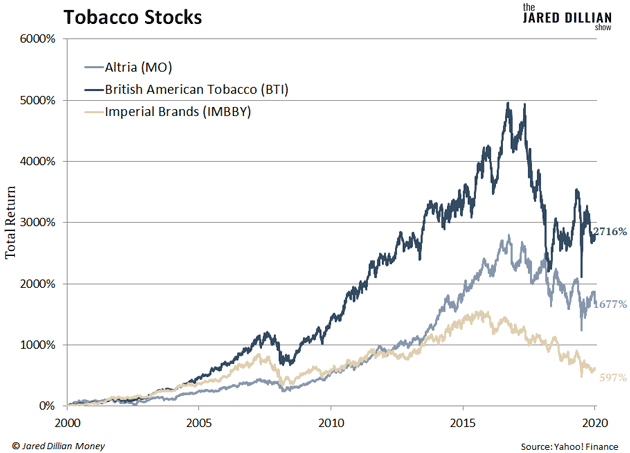

No one “supports smoking.” But over the last two decades, tobacco stocks have been some of the best-performing stocks in the world.

Altria has soared 2,716%... British American Tobacco (BTI), 1,677%... Imperial Brands (IMBBY), 597%.

For the unconstrained investors who bought shares of these companies 20 years ago, those are life-changing gains.

Look—it’s not my job to tell you what’s right or wrong. You’re a grown up, and you have to decide those things for yourself.

But it is my job to show you how to get the most from your money. And avoiding sin stocks on principle won’t help you do that.

Jared Dillian

P.S. If you’re new to investing, or simply frustrated because you’re not seeing the gains you’re after, now is the time read my FREE special report, How Do I Start Investing? Learn how to avoid “newbie mistakes” and position yourself for sizable long-term profits, regardless of how much you’re starting with. Download your complimentary copy now by clicking here.

|