Build Your Emergency Fund During an Emergency

Let me ask you something: How much physical cash do you have in your wallet?

Maybe 40 bucks, 100 bucks, 200 bucks?

What if you’re stuck at home, and you can’t get to the ATM? What if they close the ATMs? How are you going to get cash?

On my radio show, I’ve talked about keeping cash in a home safe for situations just like this. Because you never know what’s going to happen next.

Some people harp on me for encouraging folks to set aside a hefty emergency fund. They say it’s irresponsible because you should invest everything you can. You know, put it in the stock market.

No! You need at least $10,000 in an emergency fund or enough to cover six months of living expenses—whichever is greater. I don’t care what your income level is... you, me, everyone needs to do this.

Setting up your emergency fund:

- Takes priority over investing;

- It takes priority over paying down debt;

- And it takes priority over things you just really, really want.

Your Emergency Fund Number

First, add up what you spend every month on necessities, like your rent or mortgage payment, groceries, car payment, health insurance… everything you need to pay. Don’t include things like dinners out or a new big screen television. Those are not necessities.

Then multiply the cost of your monthly necessities by six. That’s your emergency fund number. If it’s less than $10,000, good for you! Your living expenses are low. But you should still put $10,000 in your emergency fund. Emergencies can be expensive, as many people are finding out.

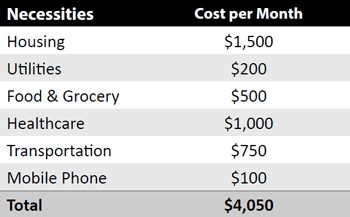

Here’s an example of what a family of four might spend each month on necessities:

In this instance, the family’s emergency fund would need to be $24,300—$4,050 per month x 6 months. That’s the minimum, but this is one of those things where more is always better. If you can pile gross amounts of money into your emergency fund, do it.

Right now we’re in the middle of a public health emergency that’s quickly turned into an economic emergency. If you’ve made it this far without an emergency fund, I’d encourage you to review your necessary expenses as soon as possible—ideally before the end of the day, if not right now.

Once you settle on your emergency fund number, you should squirrel that much cash away in a home safe or in a separate bank account, far away from the money you use for ordinary expenses. You could even split it up between the two. Either way, the goal is to almost forget about this money so it’s available to you in a true emergency.

Also, don’t worry if your emergency fund isn’t earning any interest. That’s not what this money is for. Because here’s what happens…

Someday, an Emergency Will Find You

Right now, because of the coronavirus, millions of people are being furloughed from their jobs. Pilots, waiters, hospitality workers—mostly people on the low- to middle-income spectrum. So they’re not bringing in any income.

Even if your job or industry looks pretty stable, this could drag on for many more weeks, if not months. And employment is at-will in most states. Which means, you can leave your job but you could also be asked to leave at any time. You always have to be prepared for that.

People have underestimated how fragile the economy is, and we’re just starting to see the reality. In the third week of March, a record 3.3 million Americans filed for unemployment, and things are likely to get worse for a bit.

No matter what line of work you’re in—even if you can safely work from home right now—you always need to be prepared to lose your income for some period of time. Because you never know what’s going to happen next.

Sure, there’s a tiny chance the current crisis won’t personally affect you. I certainly hope that’s the case. But sometime down the road, you will face another unexpected crisis or some flavor of personal emergency. I mean, no one gets through life unscathed.

But there are some things you can control, like having an emergency fund to carry you through to better times. Having easy, direct access to that cash via your home safe and/or a separate bank account will protect your family and add to your peace of mind during troubled times.

Jared Dillian

|