Diversification Is No Defense Against a Bear Market

Millennials have a reputation for being financial idiots.

They borrowed gobs of money to attend college, leaving them with an average student loan debt of $38k today. It’s just one of the many reasons they’ve had a difficult time saving enough to buy homes, get married, and raise children.

Even the millennials who’ve made a lot of money are making bad choices about how they invest it. CNBC recently surveyed millennial millionaires—people who had a least $1 million to invest outside of their primary residence. The survey found that “most millennial millionaires have the bulk of their wealth in crypto, and they’re planning to add more in 2022 despite the recent price declines.”

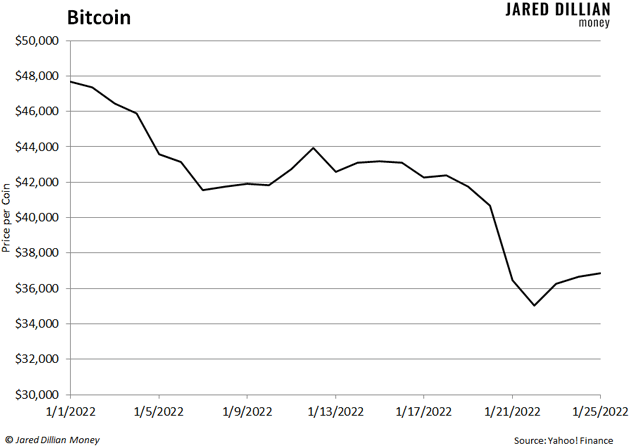

If you don’t follow the markets closely, here’s a chart showing bitcoin’s performance since the start of the year. As you can see, it’s sunk 23%.

Yet close to a third of millennial millionaires surveyed by CNBC had 75% or more of their wealth in cryptocurrencies.

Meanwhile, Matt Damon has done a commercial for Crypto.com. And FTX is now the “official cryptocurrency exchange” of Major League Baseball, which is why you saw umpires wearing FTX patches during the playoffs.

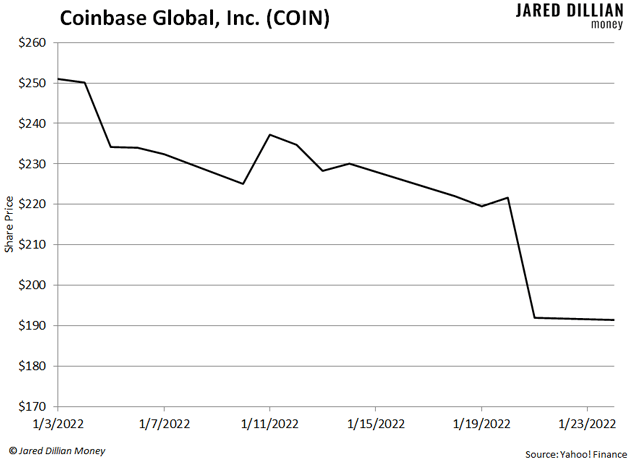

Then you’ve got millennials like Brian Armstrong, the CEO of cryptocurrency platform Coinbase. Armstrong recently bought a 19,000 square foot Bel Air mega-mansion for $133 million. It’s one of the most expensive houses in the country.

I love big houses. And Coinbase is an amazing business. But you have to wonder how this is going to play out for Armstrong if Coinbase (COIN) continues to tumble.

COIN has already dropped 24% this year, as you can see in the next chart.

Don’t Get Smooshed

Look, if you want to own some crypto, that is fine. I own some. And long term, I’m very bullish on the technology behind it. But crypto only accounts for about 1% of my net worth. So, I won’t get wiped out if crypto keeps going down.

The problem here isn’t crypto—the problem is poor portfolio construction. A young investor might have 80%... 90%... even 100% of his money in crypto. But he thinks, “Well, I own ten different cryptocurrencies, so I’m diversified.”

Wrong. If all cryptocurrencies go down, he’s going to get smooshed. Because he’s too concentrated in one asset class.

Older investors make the same mistake, except they do it with stocks. There are 55-year-old guys with 80%... 90%... 100% of their money in stocks. And they think, “Well, I own energy stocks, healthcare, tech, financials, so I’m diversified.”

Wrong again. Because a bear market in stocks would take all of that down at the same time.

-

That is why you have to diversify across asset classes.

It’s the only kind of diversification that works. That’s why we have The Awesome Portfolio, with 20% stocks, 20% bonds, 20% cash, 20% gold, and 20% real estate. Longtime readers know this is the asset allocation that offers the best risk-adjusted returns over the long haul.

If you want to add a little crypto in there, again, that is fine. But I would put it in the gold bucket—just enough so it makes up 2%–3% of your portfolio. Max.

Generation X

One final thought on the millennial millionaires…

Back in the ‘90s, I went to a lot of punk rock concerts. I jumped off the stage, crowd-surfed—all that stuff. Generation X, my generation, was one giant group of miscreants. Now we’re responsible citizens—we’re the guys running the show.

So, I’m not too worried about millennials, or Gen Z for that matter. They will figure all of this stuff out eventually. And by the time they’re 45 years old, they’ll all be voting Republican.

Jared Dillian

|