Everything Is a Trade

Here’s a story for you…

About 10 years ago, I was really pounding the table on gold. Not just as an inflation hedge (which it is). And not just as a tried-and-true way to reduce volatility in your portfolio (like it does in The Awesome Portfolio).

I was pushing gold hard.

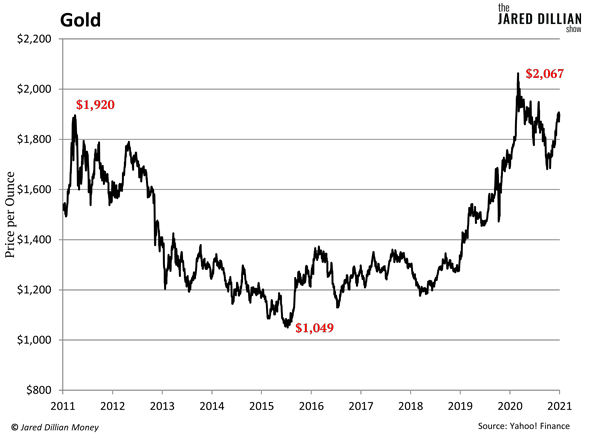

All the while, I watched the price of gold peak at $1,920 in 2011… and drop all the way down to $1,049 in 2015. Giant drawdown sandwich.

There were all kinds of warning signs this would happen, too. Like the Goldline commercials on Fox News and the “Cash for Gold” stores popping up everywhere.

But nobody was paying any attention. They were too busy declaring “I’ll never sell, not until the US goes back to a gold standard!”

Sound familiar? People were holding gold.

I had a hunch $1,900 was the top, but I thought to myself, “I can take a drawdown. I can handle it.” So, instead of selling, I held on.

Now ultimately, this approach worked. Gold briefly climbed over $2,000 last year, and it’s still trading roughly around $1,900 today.

But in retrospect, I would have gladly avoided that multi-year drawdown if I could have.

Those Years of Pain Completely Changed the Way I Trade

After that experience, my attitude changed. Now I say…

-

Everything is a trade. Everything is meant to be sold.

It’s never easy to sell your favorites. You get attached—they feel like family. But you have to do it.

Sure, my gold trade ended up being lucrative in the end. But at what cost? Years of stress? I could have put my money in any number of less stressful trades and made the same amount of money, if not more.

What If You Sell Too Early?

Selling too early is everyone’s fear. It can be tough to nail the dismount.

Deciding when to sell is 100x more difficult than deciding when to buy.

-

But if you find yourself worrying that you’re about to hit the top, sell.

Why gamble? Either you’re right about the trade hitting the top, and you make the maximum possible profit.

Or you’re wrong. You sell… the trade keeps creeping higher, and… you still made money.

No one ever went broke by taking profits.

Unloading Stressful Trading Positions Will Dramatically Improve Your Life

If you are sticking to an investment that's taken a 50% (or worse) drawdown… sell. Otherwise, you are just shooting yourself in the foot.

Remember, my primary goal here at Jared Dillian Money is to help you live a stress-free financial life. The whole point of all this is to make your life easier! And I have to say, my life started improving dramatically when I started cutting my losers.

I don’t have to live through another 50% drawdown. My mental health is too important to me.

I'm never putting myself through that again—and neither should you.

Jared Dillian

|