Evil Genius Companies

I want to devote today’s letter to Spotify. You know, the music streaming service.

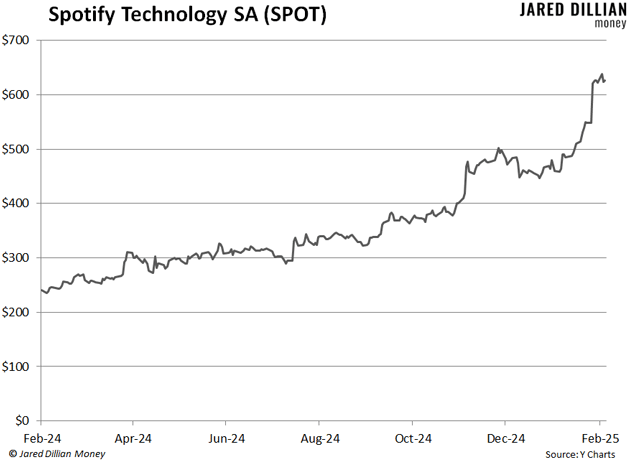

Here is a chart:

CEO Daniel Ek has now made more money than any musician in history. He has a net worth of $7.2 billion, and Taylor Swift, Jay-Z, Rihanna, and Bruce Springsteen put together are worth $6.8 billion.

This is a massive transfer of wealth from the unsophisticated to the sophisticated.

Spotify is actually a pretty crappy business. There is a fair bit of overhead, and as little as it pays musicians in terms of royalties, it can’t pay them much more because it doesn’t have the margins. Also, people are pretty price-sensitive about subscription services—raise monthly rates by a few bucks, and people are going to cancel.

I do not have a Spotify account, for a bunch of reasons. For one, I only listen to electronic music, and Spotify’s electronic music catalog is not that great. What is there is mostly radio edits. I’ve used other people’s Spotify accounts, though, and I have to admit that it’s cool—you can pull up pretty much any song that was ever recorded and play it in a second. Urban Dance Squad’s “Deeper Shade of Soul”? At your fingertips, along with Elvis and The Shaggs and GG Allin and everything in between.

Winner Takes All

There are concerns. First, you don’t own the music—if someone someday decides that Urban Dance Squad is offensive, that music literally ceases to exist. If you have the .mp3 file on your computer, it is yours forever. The same concerns are present with e-books and other forms of electronic media.

But the bigger concern is that no musician makes a meaningful amount of money on this platform. And, you know, 30 years ago you used to be able to make money on album sales. Now you have to be a hype machine so you can tour and sell tickets and merch. Not everyone is cut out for that, and it creates a winner-take-all business environment, like a lot of things connected to the internet. There is Taylor Swift, and there is everyone else. Napster mortally wounded the music business—Spotify finished it off. As I am fond of saying, s--- costs money. You want good music, you have to pay for it.

Anyway, all of this makes me sound like a Spotify malcontent, and I am, but the biggest issue is that the company trades at 180X earnings (for years, the P/E was #DIV/0). And, well, it’s an expensive stock in a market full of expensive stocks.

Expensive stocks do frequently go up. But I have to ask the question: Who is going to open a Spotify account that doesn’t have one already? The company is seeing subscriber growth, incredibly enough, but where is the continued growth going to come from? Of course, I asked the same questions about Netflix, and look at Netflix. Maybe I will be the last jerk on Earth to open a Spotify account, capitulating so I can listen to back catalogue Front 242.

The Market Cap Game

The market cap is $127 billion. Readers of The Daily Dirtnap know that I do this thing called the “Market Cap Game.” The Market Cap Game is when you eyeball a company’s market cap and determine whether it is rich or cheap. $127 billion seems high to me. It is about the same as T-Mobile US, for comparison.

If you look at the chart, the market cap was much smaller not that long ago, which kind of goes to show the psychology behind this stock.

Not that I would short it. I wouldn’t short it with your money, not with that chart. It looks like a giant priapism.

Is there an existential threat to the business? The only one that I can think of is that musicians, collectively, revolt and pull their music off the platform. Remember, this happened already when Spotify signed Joe Rogan—Neil Young famously pulled his music. I’m not talking about musicians pulling their music for political reasons but for economic reasons.

What are you giving up? A few thousand dollars in revenue? If the world’s musicians boycott and demand to be paid more (which they probably will, given how much the stock has gone up), then it’s game over for Spotify—those margins are just too small, and they’ll never get any bigger. By the way, in case you were wondering what Taylor Swift gets paid on Spotify, it’s $132 million annually. She may be a billionaire, but she’s not leaving. Not everyone is so lucky.

Nice to be Daniel Ek, I guess. He made some comments recently that the cost to create content is rapidly approaching zero. That got a lot of music producers, who will spend 500 hours creating a track, up in arms. Like I said, it’s an evil genius business model, like selling printers for $300 and ink cartridges for $80. I wish I had thought of it myself.

Jared Dillian, MFA

|