Happy Pigs Means Pricier Bacon

Inflation keeps roaring. In November, the Consumer Price Index, the go-to measure of inflation, rose 6.8% year over year.

Though I’d bet you don’t need a government statistic to tell you stuff is getting more expensive. You’re feeling it at the gas pump. You’re feeling it at the grocery store. You’re feeling it when you order Christmas presents.

Inflation is front of mind. And it’s changing people’s behavior…

Inflation Makes You Do Weird Stuff

This level of inflation, where people who don’t normally pay attention to economic matters are acutely aware of it, distorts everyone’s behavior. Say you go to Lowe’s to buy a bag of fertilizer. It costs $8. But you are worried inflation will continue to ramp higher. So, you buy 10 bags of fertilizer, use one, and store the other nine in your basement.

When lots of people do this—buy a lot more than they need—it pushes prices even higher. And it becomes a self-reinforcing cycle. Prices go up, so everyone buys more, so prices go up… over and over again.

Maybe you become a fertilizer hoarder. And one day down the road, you wind up selling fertilizer to your neighbors at higher prices. Sounds weird, but inflation makes people behave in weird ways.

Rules Only Make It Worse

In 2018, California passed an animal welfare law requiring, among other things, that pork sold in the state come from humanely raised pigs—meaning pigs that had room to roam before they were butchered for bacon.

The law, which California restaurants and grocers are trying to block in the courts, was supposed to go into effect next year. Some projections have shown bacon prices rising 60% there because of it.

Now, I love animals—I even go off meat periodically. But this is how you get inflation by fiat. It happens when laws and regulations increase the cost of running a business. Then they pass along those costs to consumers in the form of higher prices.

The Opportunity

There’s a small dose of good news here. I expect inflation to moderate a bit in the next year. That doesn’t mean things will get cheaper. It means prices will likely rise at a slower pace, possibly 4% or so.

So, you still need to protect yourself and position your portfolio to profit. Regular readers know that means owning some gold, which everyone needs a bit of anyway. It means owning some silver. It also means owning some industrial metals… something you might not have considered.

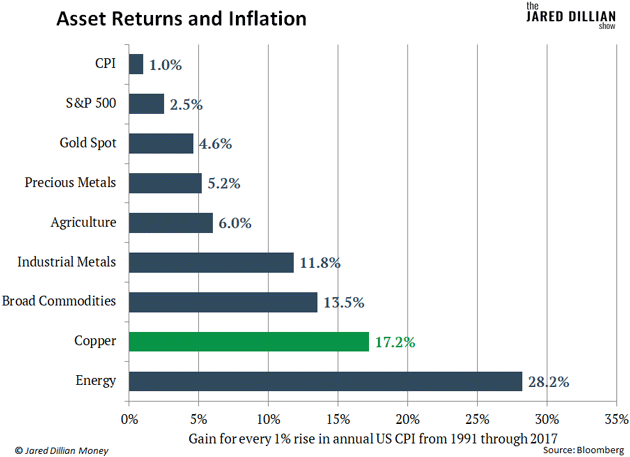

For every 1% rise in the Consumer Price Index from 1991 to 2017, industrial metals prices rose 11.8%. As a group, they outperformed gold, which rose 4.6%, and precious metals as a whole, which rose 5.2%.

Of all the industrial metals, copper did exceptionally well, rising 17.2%.

Copper has a wide range of practical applications. It’s used in electronics, industrial machinery, and the wiring and plumbing needed any time a new building goes up.

Copper also has antimicrobial properties—something people and businesses are hyper-attuned to these days. This makes it attractive for high-touch surfaces in hospitals, like tray tables, IV poles, and bedside rails.

On top of that, copper stands to benefit from the green energy trend. An electric vehicle (EV) uses about 176 pounds of copper, or more than 3X the amount used in a gas-powered car. And that’s just for the vehicle itself. EV charging stations use a lot of copper, too.

Meanwhile, renewable power sources like solar and wind farms require as much as 12 times more copper than non-renewable energy power sources.

Things look bullish from a supply standpoint as well. For the last several years, there’s been a severe lack of investment in new copper mines. That, along with booming demand, could lead to a supply crunch in the years ahead. This would push copper prices way up.

These are just some of the reasons I recently recommended one of my favorite copper plays in my special report called Inflation Bull: Eight Ways to Profit. Inflation is not a problem to be feared… it’s an opportunity to profit. And you’ll find eight specific investment recommendations to help you do just that in my report.

Click here to get your of copy of Inflation Bull now.

Jared Dillian

|