If you’re investing the right way…

Most of investing is waiting.

Say you’re playing the index fund game. You set up automatic transfers into your brokerage account, and from there you add more and more into the funds at regular intervals.

Then what do you do? You wait. For 40 years—adding more at regular intervals and letting the returns compound over time. Sounds simple enough. And yet, in some ways, modern technology has made it harder for people.

In the old days, before the internet, you never really knew what your money was doing. Your broker would send you statements once a month or once a quarter. And you could read about the markets in the newspaper and other print sources. But other than that, you were in the dark.

|

[ANNOUNCMENT] JARED DILLIAN’S STRATEGIC PORTFOLIO is now accepting new members. New Member Coupon Code has been applied on the order form linked here. Claim your limited-time discount today. (From Our Partners at Mauldin Economics) |

Now you can watch your brokerage account at every minute of every day on the 5.5” supercomputer you carry around in your pocket. The ability to access that information 24 hours a day leads to bad decision making. Because you’re checking the app at the airport… the grocery store… your kid’s soccer game… and so on. And the more you check it, the more likely it is you will see yourself losing money.

Why is that important? Because people make poor decisions when they get negative feedback. More specifically, they sell at the worst possible time, when the best course of action is to do nothing.

If you’re investing the right way, you’re spending 1% of your time trading, 9% of your time thinking, and 90% of it waiting.

What am I doing now? I am waiting for my investments to go up. Sure, there have been a few times when I’ve bought something and it’s immediately exploded higher. But most of the time, investing takes an incredible amount of patience.

-

In the meantime, there are going to be drawdowns.

And the drawdowns are tough.

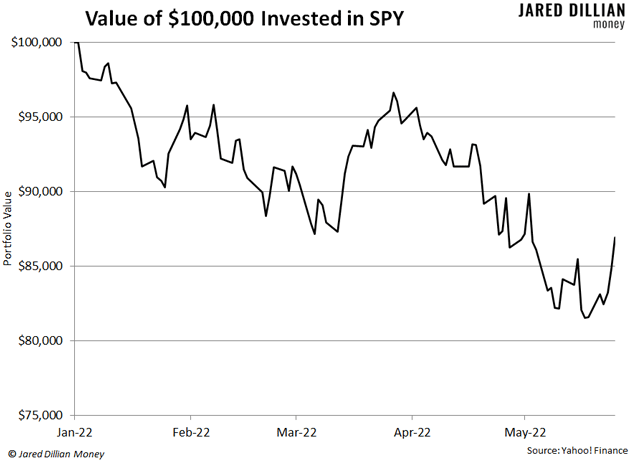

For example, the S&P 500 is down 13% this year. So, if you had $100,000 in the SPDR S&P 500 ETF Trust (SPY) at the beginning of the year, you’re sitting on a $13,000 loss.

Hopefully, this does not represent all your investable assets. (Nobody should be 100% in stocks. If you’re familiar with the Awesome Portfolio, you know that.) Now your job is to wait. But that is hard because you are a human being hardwired to avoid loss and pain.

-

This is one of the reasons people build more wealth through real estate than anything else.

It’s easier to buy and hold. It’s impractical and the transaction costs are too high to buy and sell a new house every day, every month, or even every year.

So, you spend a solid chunk of time researching neighborhoods and comparing your options. Then you buy a house, and you stick with it for five or 10 years, maybe longer. Sure, you can look up the price on Zillow 24 hours a day. But it’s difficult to act spontaneously on that information. So, you hold on.

This is one of the reasons the Myrtle Beach area is full of people from places like Queens, NY, who bought an $80,000 house 40 years ago. They paid off the mortgage, and now they can sell the house for $800,000, move south, pay $300,000 for a new house, and live off the rest. Really, for most people, a house is the best investment they will ever make.

-

Try to treat your stocks like a house.

Imagine that trading stocks carries a 7% transaction fee and that selling would involve all the cumbersome activities involved with moving. Sorting through the junk in your garage. Taping boxes together. Accidently breaking things while you wrap them in tissue paper. You would be much more selective about what you bought and far more hesitant to sell if you had to endure that with every stock trade.

If you pretended your stocks were like a house, my guess is you would buy and hold for 7… 10… 20 years or more. And you would likely be better off for it.

Jared Dillian

|