Put 20% of Your Portfolio Here…

It’s no secret where I recommend putting your money.

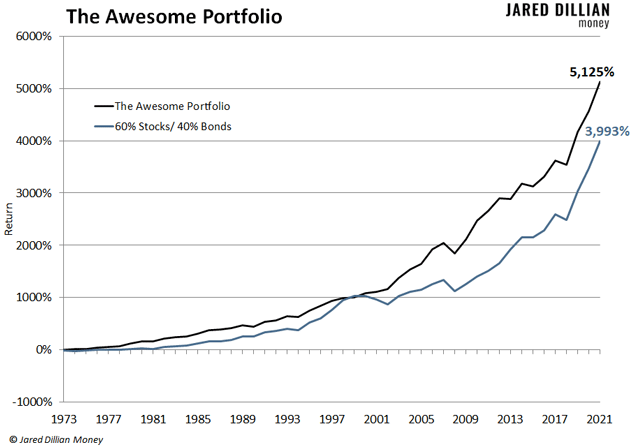

Nearly all of your investable assets should be in a stable, well-diversified portfolio of 20% stocks, 20% bonds, 20% cash, 20% gold, and 20% real estate. This is the Awesome Portfolio I’m always going on about—the portfolio that produces the best risk-adjusted returns over the long haul.

My analyst Adam and I have back-tested its performance over five decades. Turns out, the Awesome Portfolio carries less risk while outperforming the so-called “safe” 60/40 portfolio—which has turned out to be much less safe than people thought (it’s down 11.6% this year).

Despite its clear advantages, I still get a lot of questions about the Awesome Portfolio. And one of the most common is—

-

“Do I really need to own bonds?”

I suspect one of the reasons people ask that is: They don’t know anything about bonds.

If that sounds like you, take heart—you are not alone. The bond market is bigger and more important than the stock market. Yet many individual investors ignore it altogether. We have a cult of equity here in America. People just love their stocks.

Anyway, the answer is yes, you really need to own bonds.

|

Learn How to Build “The Portfolio All Investors Should Have” |

-

You can think of a bond as a loan, but you are the lender.

How does this come about? Sometimes a company or a government needs to borrow money, and issuing a bond is one way to do that.

Investors buy the bonds in exchange for interest payments. Eventually, when the bonds mature, the investors get back their principal, meaning the amount they originally loaned to the company or government. At least, that’s what usually happens.

All investments carry risk, including bonds. Some bonds are never fully repaid, but that is not the norm. In general, bonds are stable, steady investments that pay you interest.

There are many different kinds of bonds, and some are riskier than others. The three major credit ratings agencies—Moody’s, Standard & Poor’s, and Fitch—rate bonds based on the financial health of the company or government issuing them. For each, the top ratings are called “investment grade.” The bottom ratings are “non-investment grade” or simply “junk.”

You want to spread your risk across a huge pool of bonds.

-

Bonds also tend to produce lower returns than stocks.

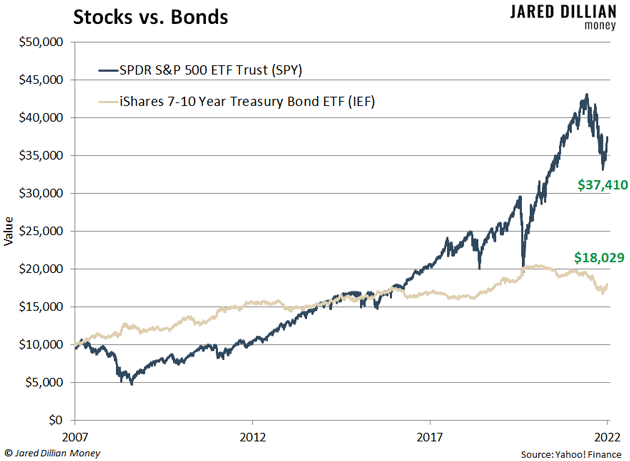

Let’s say you invested $10,000 in the SPDR S&P 500 ETF Trust (SPY) 15 years ago. Today, that investment would be worth $37,410.

Now, let’s say you invested $10,000 in the iShares 7–10 Year Treasury Bond ETF (IEF) 15 years ago. Today, that investment would be worth $18,029. So, the stock investment would be worth $19,381 more than the bond investment.

-

So, why in the world would you buy bonds?

Because bonds are much less volatile than stocks. They might not return as much, but bonds will lower the overall risk level of your portfolio. And that is what you want—a portfolio that steadily grows and won’t get annihilated when something bad happens.

I’ve been extolling the virtues of a bond-heavy portfolio for years, especially for people in or near retirement. That used to mean holding 65% of your portfolio in bonds. Now it means holding enough bonds that they make up 20% of your portfolio.

Of course, if you’re going to put 20% of your investable assets into something, it’s a good idea to learn a little bit more about how that something works. You have some options here.

You could buy a giant textbook filled with a wall of intimidating math. You could sign up for a college course covering bond finance—but that takes a lot of time, costs a solid chunk of change, and there’s a good chance you’ll have little practical knowledge by the end.

Or you could take The Bond Masterclass. I built this course to teach people outside of the finance world everything they need to know about bonds in a quick, simple, inexpensive format. When you get to the end of the course, I walk you through how to build your own bond portfolio. Learn more about The Bond Masterclass here.

Jared Dillian

|