Stop. Wait to buy that house

Mortgage rates are soaring.

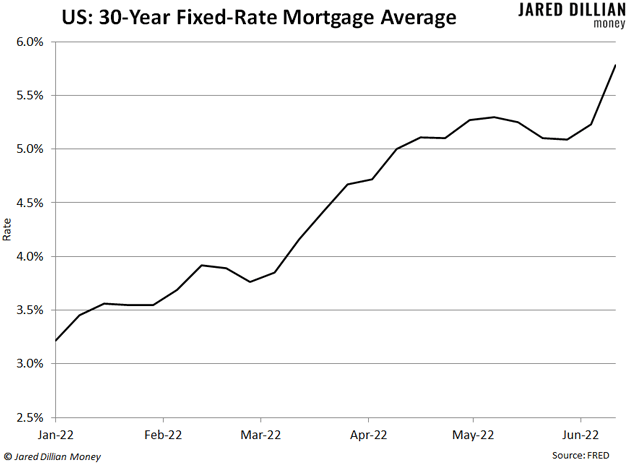

Here’s a chart of the average 30-year fixed-rate mortgage since the start of the year. As you can see, it’s shot from 3.2% to 5.8%, with a big surge in the past couple of weeks.

Is this the end of the world? It sure feels like it to some people. Of course, mortgage rates have been much higher than this. For instance, my first mortgage back in 1999 was 7.25%.

So, why are higher mortgage rates such a big deal now? The real problem isn’t higher rates. The problem is how fast they’re rising. The speed of change is what matters.

-

What does this mean for home buyers?

The housing market has been hot for a while, with low inventories of homes for sale and sellers getting multiple offers over their asking prices. All that is going to end.

Intuitively, this makes sense to people. There is an inverse relationship between mortgage rates and home prices. Maybe you can afford a $400,000 house with a 5% mortgage, but you can’t afford it with a 6% mortgage.

So, housing prices will have to come down—but not immediately. They might drop 10% over the next six months. That means, if you are thinking about buying a house, and you can wait… you should wait.

|

[ANNOUNCEMENT] JARED DILLIAN’S STRATEGIC PORTFOLIO is now accepting new members. New Member Coupon Code has been applied on the order form linked here. Claim your limited-time discount today. (From Our Partners at Mauldin Economics) |

-

In the meantime, renting is not a bad idea.

We all need to live somewhere. And yes, renting carries a stigma. People think it means you’re irresponsible. But not everyone should buy a home.

You should rent if:

-

You think houses are overpriced and set to drop (like now).

-

You don’t have a cushion if things go wrong.

-

You wouldn't do a great job of taking care of a house.

-

You are, in fact, irresponsible.

-

Your rental payments are lower than a mortgage payment on an after-tax basis (including property taxes and insurance) for a comparable home.

Sometimes, renting makes you even more of a responsible adult, particularly if you’re doing it as part of a larger plan.

-

Yes, yes… buying a home is the best investment most people ever make.

Most people are terrible savers. And the 30-year fixed-rate mortgage is a forced savings program. With each monthly payment, you pay down a little bit of the principal. Over time, you build equity. It happens slowly at first, and then picks up speed. Before long, you own 30, 40, or 50% of your house.

If you make prepayments, you dramatically shorten the length of the mortgage. It doesn’t take much. Prepay just a little bit of it, and you knock years off the mortgage.

-

And yes, building equity in your home is super important.

As I’ve said before, Myrtle Beach is full of people from Queens who sold their homes for $900,000 after paying the house off over 30 years. Many of these people have no other savings. So, they sell their house, take the cash, move south, pay $300,000 for a house, and live off the rest.

But building equity and paying off your mortgage becomes difficult (if not impossible) if you buy a house that’s too big or too fancy or just plain overpriced. The last thing you want is to buy a $500,000 now, just to find it’s worth $450,000 by Christmas.

I do not expect another housing crash like we had in 2007/2008. But housing is a major driver of the economy—I do expect housing prices to drop, and I do expect a recession. Most of this is outside of your control. But if you’re in the market to buy a house, you can control when you do it. Just wait.

Jared Dillian

|