Two Charts for the New Year

I’m thinking that 2025 is going to be different from 2024, even though 2024 was not different from 2023.

After all, we are getting a new president, and one party is in control of all three branches of government. There is an anti-bureaucratic movement sweeping the globe. People are openly tweeting Milton Friedman and Thomas Sowell quotes. We’re talking about eliminating entire Cabinet departments. We’re talking about terming out the US debt. We’re talking about lowering taxes. There is unironic discussion of doing things like eliminating the income tax.

Usually, it is a safe bet that nothing will change, but perhaps not this time.

So, people are optimistic—optimistic that Trump will cut the size of government, slash regulations, and lower taxes, which will result in a four-year economic boom. The question is: How much of this is priced in? Stocks rallied relentlessly into the election, and even Stan Druckenmiller commented that Trump was mostly priced in.

I think a lot of it is priced in, if not all.

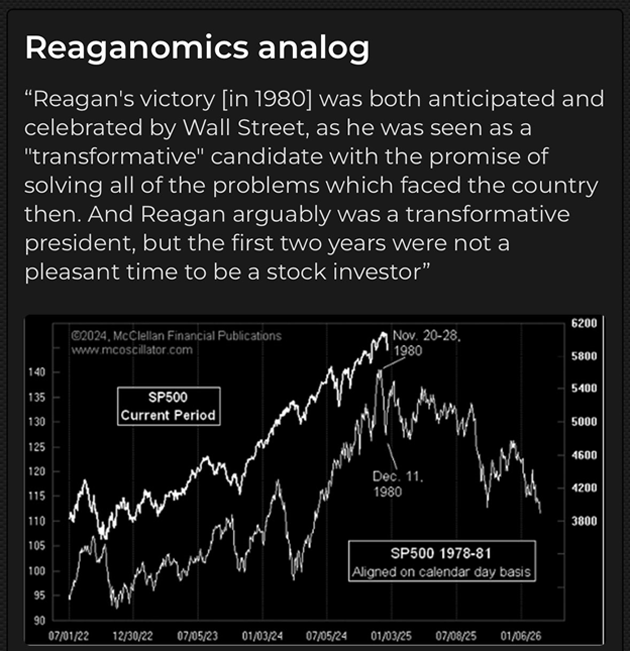

Exhibit A: an infographic from my friend George Noble, talking about how there was a similar setup in 1980, with the free-market Reagan getting elected and the stock market rallying into the election, with expectations that there would be an economic boom.

For those of you who were alive back then, you know that the first few years of his term were not good for stock returns.

Source: McClellan Financial Publications

That is chart #1.

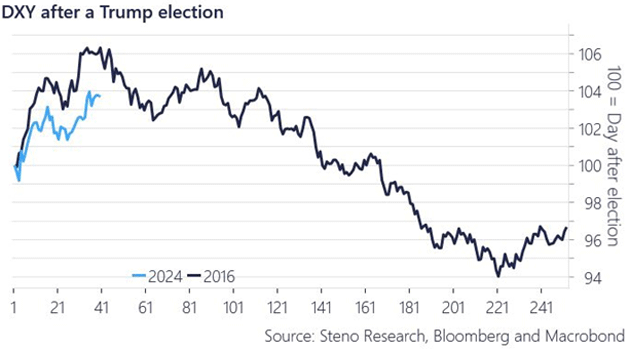

Chart #2 is about the value of the dollar. The assumption has been that a Trump victory would be bullish for the dollar (because of tariffs), but that’s not what happened in Trump’s first term, where he aggressively talked down the value of the dollar.

That seems likely again this time—JD Vance made some explicit weak-dollar statements leading up to the election. If the tariffs really are implemented, the already-expensive dollar will rip higher, so the government will have to take some action to weaken it, up to and including currency interventions.

Source: Andreas Steno Larsen

So, I am expecting an eventful year. I am expecting an eventful January! Throw in the fact that people were sitting on a mountain of capital gains in 2024, and they might want to take those gains the moment the calendar rolls over. January could be a rocky month.

Terming Out the Debt

One of the untold stories of the last four years is the gross incompetence of Janet Yellen and the Department of the Treasury in how it financed the US government.

During the pandemic, interest rates went to zero, pretty much across the curve. Now, if you were in charge of financing the government, you would think that you would paste the market with as many 30-year bonds as possible, extending the weighted average maturity of our debt and locking those low rates in.

But she didn’t. Instead, she financed most of the debt in bills, which carry significant refinancing risk, and when rates went higher, the interest expense of the debt grew rapidly. Pre-pandemic, the government was spending $300 billion a year on interest expenses. Now, it is over a trillion. Half of that was preventable… if Yellen had termed out the debt.

Why didn’t she do it? Politics. She took the easy way out. By issuing loads of debt in longer maturities, she would have caused long-term rates to rise, which would have caused mortgage rates to rise, which would have been unpopular. Short-term gain, long-term pain.

Now we have a real budget crisis on our hands, and it will fall to incoming Treasury Secretary Scott Bessent to do the right thing and term the debt out—at 4%-plus—in the event that it goes higher. And if it does go higher before we term out the debt, it is financial Armageddon.

Incompetence. Yellen is smart but not a risk-taker. She couldn’t do the hard thing.

You might have noticed that Treasury yields have backed up significantly in the last two months. What’s happening is that rates are rising in anticipation of future supply, and long maturities are getting hit the most. Those auction sizes are going to be very large.

On to 2025

I have a big 2025 coming up, with another book coming out in the summer (RULE 62: Meditations on Success and Spirituality) and I’m halfway through another manuscript right now (THE AWESOME PORTFOLIO). Once I finish that, it will be time to work on the dystopian fiction novel I started a few months ago (ROUND ZERO). If I successfully publish all of these, I will be up to eight books.

And finally, do me a solid—I recorded a great mix last week of my favorite house music; this has universal appeal. Do not have contempt prior to investigation. Click on it, you might like it! Here it is: "Licks of Love."

Jared Dillian, MFA

|