Your Most Critical Financial Task of the Year

What will go wrong this year?

Maybe nothing. And I certainly hope that’s the case for you. But I cannot predict the future, and neither can anyone else. That is why you want to prepare, as best you can, for the unexpected.

And that starts with your emergency fund.

One of the most important personal finance tasks for everyone—at every income level—is to build up a sizable emergency fund. This is more important than investing. And believe it or not, it is more important than paying off debt. (More on that momentarily.)

Everyone needs an emergency fund. This is where you keep money to handle the unexpected expenses that can and will inevitably occur. When your car engine blows, or your roof starts to leak, or you’re hit with a surprise medical bill, these all qualify as emergencies. And you need money on hand to pay for them.

How Big Is Big Enough?

Your emergency fund should cover six months of living expenses, or $10,000—whichever is greater.

Add up the cost of everything you need to stay afloat each month, like your rent or mortgage, groceries, car payment, health insurance, and medications. Be honest with yourself about how much your day-to-day life really costs. But don’t include things like dinners out, a new iPhone, or that trip you were hoping to take.

Then multiply the cost of your monthly necessities by six. That’s your emergency fund number. If it’s less than $10,000, great—your living expenses are low. But you should still put $10,000 in your emergency fund.

Emergencies can be expensive. A new car engine might cost $4,000–$7,000… a new roof, $5,000–$10,000. And a medical emergency? The potential financial burden there is practically limitless, and you want to be ready.

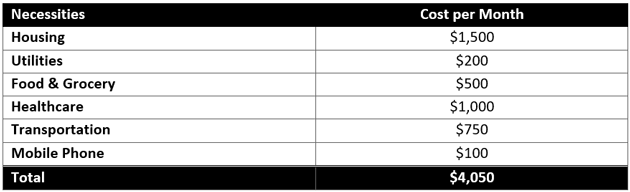

Here’s an example of what a family of four might spend each month on necessities…

In this instance, the family’s emergency fund should be $24,300, or $4,050 per month, times six months. Your list will likely include other necessities specific to you and your family, but you get the picture.

Bank It and Forget It

Keep your emergency fund in the bank. Period. It should live in a separate savings account, away from your other bank accounts. That way you won’t spend it by mistake. The goal is to almost forget about it. That way, you can quickly and easily access the funds if and when you need them.

This next part is crucial: Never invest your emergency fund. Don’t put it in stocks. Don’t put it in crypto. Don’t put it in anything but a plain, vanilla savings account at a bank or credit union.

And don’t worry if your emergency fund isn’t earning much interest. You want zero risk of loss here. If the day comes when you need that money, you’ll be thankful it’s there.

Annual Check In

If you need to use some of your emergency fund, the first thing you should do once the emergency passes is rebuild your emergency fund. At that point, recalculate six months of expenses. There’s a good chance the amount you need has gone up. And if it wasn’t above $10,000 before, it might be now.

This is a good exercise to go through once a year. And the beginning of the year—today even—is as good a time as any. Take a look at your expenses and increase your emergency fund as needed. This will also force you to look at your monthly spending, which is a powerful exercise on its own. Your spending habits might surprise you.

The Debt Question

Now, I mentioned earlier that building your emergency fund is more important than paying off debt. That might sound counterintuitive, but if you don’t have an ample emergency fund, and an emergency does happen, it will only exacerbate your debt problems.

Because here’s what happens—you wind up putting the emergency expense on a credit card or borrowing from family. Or worse, you take out a high-interest payday loan, and your troubles compound from there. Not good.

That debt still needs your attention, and we’ll talk more about it next week…

Jared Dillian

|