20 Finance Laws to Live By

Ritholtz Wealth Management's Ben Carlson has talked about the “20 most important personal finance laws to live by” in Fortune before. Today, I want to share Ben's rules and my take on each topic.

Establish a Healthy Relationship with Money

There are two types of people in this world: cheap f***s (CFs)—people who spend a little—and high rollers—people who spend a lot.

The Killer Instinct Separates Winners from Losers

I have had about 10–12 interns over the years, and I have taught a lot of college students, and occasionally I have smart interns or smart college students, but the one thing that absolutely cannot be taught is the killer instinct. You either have it or you don’t. You either have the insatiable desire to succeed or you don’t.

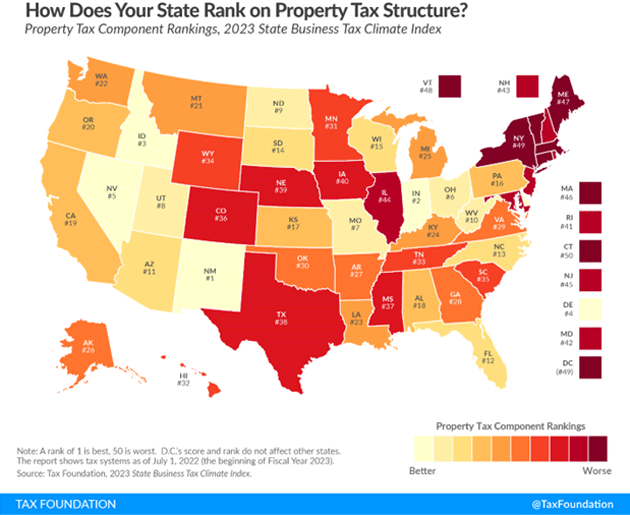

Property Taxes—Where Does Your State Rank?

If you own a home or you're thinking about buying one, I have some bad news.

Even after you pay off the mortgage, you still don't own the property. Not fully, anyway.

From a philosophical standpoint, you're renting the house from the government. That payment comes due in the form of property taxes.

Property taxes are the worst kind of taxes. However…

I'm Happy to Pay Another Kind of Tax

It isn't income taxes. When you tax people's work and efforts, they want to work less. It's just like taxing their property. You discourage people from wanting to own any.

But when you tax sales, you're discouraging consumption… and that's exactly what we want to do.

If you tax something, you get less of it. Less income, less property, and less sales.

I would be happy with income taxes being cut in half and sales taxes being twice as much.

Give me an 18% income tax rate and a 20% sales tax rate—and get rid of property and estate taxes, and I'd be happy as a clam.

Unfortunately, we can't rewrite the tax code. But there is something we can do…

How to Land a Better Tax Deal

When you are shopping for a house, look at the property taxes. If it's higher than other houses, you have to factor that into your decision.

I once owned a rowhouse in New Jersey. When I bought it, the taxes were $6,000 a year. Five years later, they were up to $14,000. I had a tough time selling the house for that reason.

High property taxes reduce the value of your home. In this case, it was substantial—I took a $60,000 loss on that house.

Property taxes are also high in Connecticut, New York, Vermont, Maine, and Massachusetts, plus the District of Columbia. They're high in Texas, too, but there's no state tax.

Source: Tax Foundation

On the flip side, states with the best scores on the property tax component this year are New Mexico, Indiana, Idaho, Delaware, and Nevada.

Whether you're looking to buy or sell, do your homework now to make sure you don't get a nasty surprise at the closing.

Just like property taxes can impact your home's value, real estate can make a big impact on your overall portfolio value. This guide shows you how to make your investments work hard for you in every kind of market.

Jared Dillian

|

Don’t Light Your Money on Fire

I know a lot of people who have gone broke because they told themselves, “I can afford the monthly payment.”

This Number Dictates How Much You Can Save

The other night, my wife and I went out for dinner. When it came time to order dessert, I couldn’t help but think, “Is it really worth shelling out $13 for a piece of cake when we have other expenses, like building a big house?”