The All-time Best Way to Make More Money

Most people want more money. Far fewer are willing to do what it takes to get it.

Don’t Stiff the Delivery Guy

Most personal finance experts turn people into lousy tippers.

What to Do If You’ve Made This Common “Mental Accounting” Mistake

Let’s talk about Mental Accounting.

No, don’t yawn. This is one of those things that is so simple, people simply gloss over it. Then they end up getting bit in the *ss.

Mental Accounting is a concept and a field of behavioral economics developed by Richard Thaler, a Nobel Prize-winning economist. Really smart guy.

-

It basically says we spend, save, and invest based on emotion rather than logic.

Or, as Investopedia puts it:

“Mental Accounting contends that individuals classify funds differently, and are therefore prone to irrational decision-making in their spending and investment behavior.”

Just about everyone is guilty of it at one time or another. The good news is, as soon as you recognize that you are doing it, you can start to correct your course.

So, What Does Mental Accounting Look Like?

We all know a dollar is worth a dollar (all money is fungible). But when you tie a feeling to it, it’s suddenly worth MORE or LESS.

Example 1

You open a special vacation savings account with $5,000, while carrying a car note worth $5,000.

The savings account has a 0.57% interest rate. That’s under 1%. You are making jack squat.

Your car loan has a 4% interest rate. So, on top of your $5,000 in principal, you’ll pay another $425 or so in interest.

Mental Accounting says, “I’m going to save up for my vacation, so I don’t put it on a credit card! This is a great decision that makes me feel good.”

-

When really, if you wanted to do the most beneficial/logical thing, you’d take the $5,000 you have in that vacation fund and apply it to your debt.

Paying off your debt, in this case, saves you from paying an extra $425 in interest.

Example 2

Now, this is one of the most insane things that people do.

-

Someone has $50,000 in cash. It’s sitting in a basic checking account and accumulating 0% in interest.

-

They also have $100,000 in debt in credit card debt at 15% interest.

Now, of course you've got to have six months' worth of expenses saved up for an emergency. So, let's say that's $20,000 of your total amount saved. This leaves you with $30,000 in cash.

What do you do?

Honestly, most people are going to leave that $30,000 sitting in their bank account.

Why? Because it makes them feel richer if they have that cash.

They like looking at it. Their need to feel good when they check their account balance makes them irrational.

-

If they wanted to break out of their Mental Accounting trap, they’d take that $30,000 and apply it toward their $100,000 credit card debt.

They’d also be spared paying an additional $24,479.07 in interest payments. (Based on making a minimum payment where principal is 1% of the payment.)

You Have to Look at It from a “Net Worth” Position

I know people, personally, who fall into this Mental Accounting trap on a very large scale.

They'll have multiple six-figures in debt, and multiple six-figures in savings.

I'm like, “Look, just collapse the balance sheet. Just pay off the debt.”

You have to understand how Net Worth is calculated.

It's Assets and Liabilities. You use the assets to pay down the liabilities.

If you have $100,000 in your bank account and $100,000 in debt, your Net Worth is $0.

-

But if you pay off the debt, you could have a positive Net Worth as early as your next paycheck.

You'll probably get far more enjoyment from looking at your bank account when you do it this way.

Found Money Isn’t Play Money

A dollar you earn and a dollar you find on the ground is still $1. It’s fungible.

Yet most people treat a found dollar like something “extra.” Something they can go blow on whatever they want.

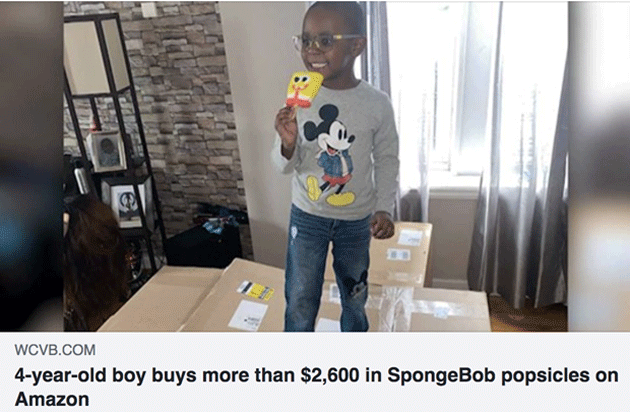

This you? Source: WCVB.com

I could make a list of things people treat like play money.

In fact, let me do that...

-

Bonuses… royalties… inheritance… lottery winnings… stimulus checks… and, *drum roll* your IRS refund.

Getting a check from the IRS is generally regarded as “found money” or a “windfall.” You use it to go shopping, or pop off on a weekend trip, right?

BZZT! Wrong.

That money was originally a part of your earnings. They overcharged you tax-wise and then returned YOUR money.

It's not “extra” money. It's a restoration of your money.

Money is Money is Money.

And we’re supposed to use our money to decrease our debt and increase our net worth.

But if we categorize our money based on emotionality (and I’m not trying to be crass), we are screwing ourselves financially.

Everybody Makes Mistakes

Even if you read this and are ready to break your Mental Accounting habits, be kind to yourself. No one gets this right 100% of the time.

I was out to dinner with a subscriber over the weekend, and I mentioned a recent corn trade where I made some pretty good money.

A little while later, we were talking about a watch I wanted to buy. So, I showed him a picture of the watch.

He said, “Why don't you buy the watch?” I answered, “Maybe I will! I just made $X on my corn trade.”

Again, BZZT! Wrong.

That violates the fungibility of money. I'm treating the money I made on my recent trade as found money.

“I can blow this money on the watch I want.”

But the money I made on that trade isn't different from any of my other income.

It was windfall income (an unexpected influx of cash), but still income.

-

My personal rule is to spend no more than 10% of any windfall, and that watch was way more than that. So, I won't be getting it.

When I do buy that watch, it will be because I have the cash in hand for it.

Put the Money Where It Does the Most Work

Who cares if you made it, won it, or found it? It’s your money.

If you made $1,000 this week and found $50, you have $1,050 in income. Not $1,000 in income and $50 in play money.

They aren’t separate.

You have to put your money where it does the most work.

If you have debt, every dollar beyond your monthly expenses and emergency fund needs to go toward paying down that debt.

(If you are debt-free, have maxed out your retirement, have a healthy emergency fund, and a steady income, then see last week’s article.)

This seems straightforward. But people don't do it. Why? Because we’re irrational/emotional.

We feel like the cash we saved up for a home or a child's college fund is just too important to relinquish—even if doing so is the logical/beneficial thing to do.

Debt is stress. It’s a bane to your mental health.

So, even though jumping the Mental Accounting hurdle can be a challenge up front, if you do it…

You’re THAT MUCH CLOSER to getting that debt-monkey off your back and seeing positive Net Worth.

Jared Dillian

|

How Not to Become a Rich Jerk

There are probably 50,000 books written on how to handle failure.

The Cult of Home Ownership

When I talk to young people in their late 20s, early 30s, they all say the same thing:

“I really want to buy a house.”

‹ First < 8 9 10 11 12 > Last ›