20 Finance Laws to Live By

Ritholtz Wealth Management's Ben Carlson has talked about the “20 most important personal finance laws to live by” in Fortune before. Today, I want to share Ben's rules and my take on each topic.

Establish a Healthy Relationship with Money

There are two types of people in this world: cheap f***s (CFs)—people who spend a little—and high rollers—people who spend a lot.

The Killer Instinct Separates Winners from Losers

I have had about 10–12 interns over the years, and I have taught a lot of college students, and occasionally I have smart interns or smart college students, but the one thing that absolutely cannot be taught is the killer instinct. You either have it or you don’t. You either have the insatiable desire to succeed or you don’t.

For every person who has the killer instinct, there are a hundred who are complacent. Then there is the rare breed of cat for whom it is never enough. They will sacrifice their social lives, their fun, their health, and their sanity to achieve their goals.

Not many people are willing to make those sacrifices. That is why there are winners and losers.

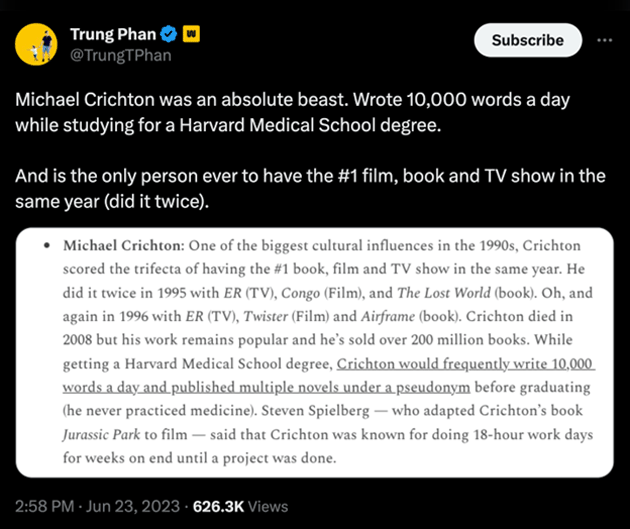

Check out this blurb about the writer Michael Crichton:

Source: @TrungTPhan

That is one first-class motor. Does that make you feel lazy? By the way, the typical book is 85,000 words, so this is writing a book in 8.5 days. For comparison, I write about 3,000–4,000 words a day across all my ventures, and people think that I’m a writing juggernaut.

* * * * *

DEADLINE: Speaking of ventures, I’ve been informed that the limited-time bundle of my premium services—the Strategic Portfolio, The Daily Dirtnap, and Street Freak—will be pulled offline soon. So, if you’re interested in joining, make sure to check it out before the offer expires.

* * * * *

Hard Work vs. Talent

There is an ongoing debate about whether hard work or talent is responsible for someone’s success. I’m going to go with hard work eight times out of 10.

It’s central to how I got a job on Wall Street…

At the time, I was getting my MBA at the University of San Francisco. Funny thing about that program. The education was first-class. Couldn’t have been any better. But its reputation, as a business school, was… not so great?

I think, at the time, it was ranked 170th out of all MBA programs in the country—well into the third tier. I went there because Stanford and Berkeley were incompatible with my Coast Guard work schedule. At USF, I could do all the classes at night. But what I quickly learned was that not all MBA programs are created alike, and at the lower-ranked ones, your likelihood of getting a job on Wall Street were slim to none.

I was undeterred. I exploited every contact I had, set up informational interviews in New York, and made several trips out East to visit with these people. Not all of these meetings were successful. But my message seemed to be resonating at Lehman, which liked the idea of a scrappy Coast Guard guy becoming a trader.

I make it sound easy, but this was not easy. I was working a full-time job, another part-time job (on the options exchange), taking three classes at once, doing job search prep, and flying out for interviews. I was sleeping two hours a night. But I had that killer instinct—failure was not an option.

I took everything I had and bet it all on myself. It would be one of two big risks I would take in my lifetime, and it paid off.

The Entrepreneur’s Dilemma

Back in 2016, Randi Zuckerberg laid out the entrepreneur’s dilemma. You have a list of five things, and you only get to choose three. I have altered it somewhat for our purposes:

-

Work

-

Sleep

-

Friends/Family

-

Fitness

-

Fun

I choose Work, Sleep, and Fun. I don’t spend much time with friends or family, and I don’t do much in the way of fitness. I always make sure I get enough sleep—sleep is important. And I make time for fun, which usually involves music.

I also work all the damn time. In my career, I have occasionally been outsmarted, but I have never been outworked.

I think a lot of Wall Street people choose Work, Fitness, and Family. They get up at 3:30 am to work out in the gym, they put in a 12-hour workday, and they come home to spend a few hours with the kids. Rinse and repeat.

By the way, if you’re only putting in an eight- to 10-hour day, then you don’t get to choose work… because everyone puts in an eight- to 10-hour day. It is what you do with those extra hours that is important.

I’m not saying that my choices are prescriptive—everyone has different priorities. I don’t particularly care if someone doesn’t want to put in the effort. That is a choice. But avoiding effort means you lose the ability to complain that you’re not rich or successful.

If you want to chug along and make your $X a year and raise your kids and watch your football on the weekends, there is no dishonor in that.

I have said this before, and I’ll say it again: The most important decision you will ever make is what to do with the next 24 hours.

Jared Dillian

|

Use This Strategy to “De-Risk” Your Portfolio

When most people buy stocks, they find cheap ones and wonder why their trades don't work.

Your Top-Down Approach to Investing for Long-Term Success

The stock market is no place for amateurs.

This Number Dictates How Much You Can Save

The other night, my wife and I went out for dinner. When it came time to order dessert, I couldn’t help but think, “Is it really worth shelling out $13 for a piece of cake when we have other expenses, like building a big house?”