How Do You Feel About Money?

One of the common misconceptions about money is that you need a lot of it to be happy. But if your basic needs are met and you don’t have any debt or risk, you can live paycheck to paycheck and be perfectly content.

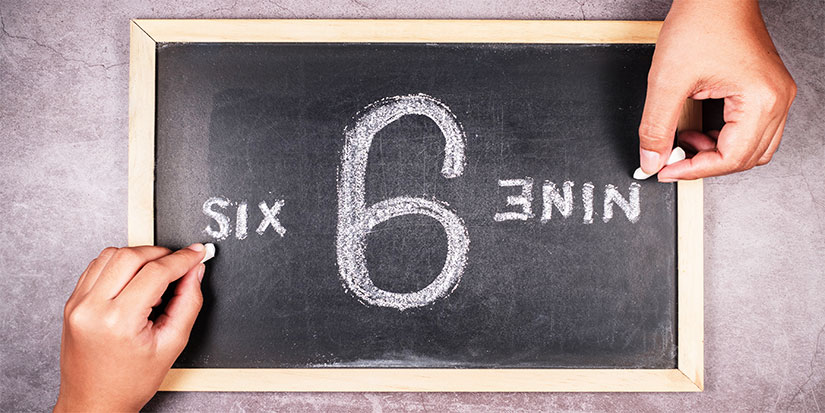

A Matter of Perspective

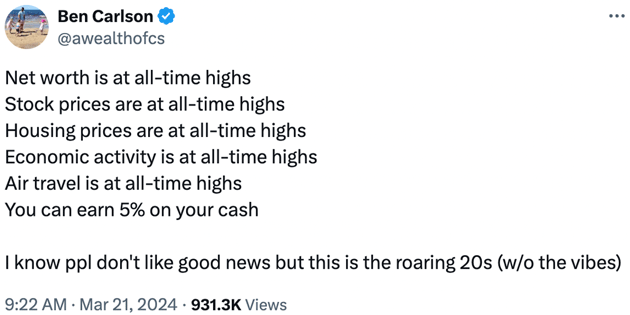

A tweet from Ben Carlson of Ritholtz Wealth Management made the rounds last week:

Source: Ben Carlson

Source: Ben Carlson

You would think people would be happy. Are you happy? I am not happy.

Some counterpoints:

-

Drug overdoses are at all-time highs.

-

Homelessness is at all-time highs.

-

Use of food stamps is at all-time highs.

-

Oh yeah, we just had a lot of inflation, and we’re probably going to get more.

-

The national debt is skyrocketing higher.

-

There are wars all over the place.

I think everyone intuitively knows that despite the bubble stock market and rock-bottom unemployment, things are not as good. Certainly not as good as they were in the late 1990s.

But it is a matter of perspective and what you choose to focus on. You can focus on the negative, or you can focus on the positive. People were doing some handwringing about the national debt in 2000 when it was a fraction of where it is right now, and yet we have had not much in the way of consequences from it—yet.

You know what has gotten a lot better in the last few years? Inequality, if you care about that sort of thing. I don’t have the charts at my command but believe me when I tell you that wages on the low end have come up a lot relative to the high end. Of course, food prices are 40% higher than they were before the pandemic, so the effect is mooted, but there is at least progress on that front.

Optimism does not come naturally to most people. It seems to come naturally to Ben Carlson. I will say this: Things could be worse. They could be much, much worse. For example, we could have another round of inflation that drives up food prices another 40%. We could have 9% mortgages, on account of interest rates going up from excessive debt issuance out of the government. We could be in a hot war with China, which will really drive up inflation. We could be in the midst of a credit crisis of some sort. And finally, the unemployment rate could go up. I have no idea what would cause that to happen, but it could happen.

So, Ben is right—things are pretty good right now. But I think most experienced market practitioners know that pain could be just around the corner.

Extremes

One thing I think about sometimes is how crazy it is that there are futures listed on the S&P 500 Index. I mean, what is the point of having futures on something that goes up all the time? Who would ever want to be short?

Another thing I think about sometimes is the idea that markets go to extremes. As you know, the S&P 500 got down to 666 on March 9, 2009. It is currently over 5,200. 666 didn’t make a lot of sense from a fundamental standpoint. The stock market will probably rally until we reach some upside level that is equally absurd. Or maybe it is simply a function of liquidity. The market is up over 25% since the Federal Reserve did its dovish pivot last year, and it’s credibly threatening to cut rates going into the end of the year. Kind of tough to be short in these circumstances. It really didn’t make a lot of sense for the stock market to be where it was in March 2009 given that the Fed had just begun quantitative easing in 2008. If we knew then what we know now.

We’re getting monetary stimulus, we’re getting fiscal stimulus, and economic activity has accelerated under an inflationary psychology. I talked to a friend of mine last week, who remarked that his coffee had gone from $7 a can to $25 a can. Now, he buys five at a time—which exacerbates the problem.

Here is where I start dispensing advice: With interest rates at 5.5%, you should be saving, not spending. Interest rates are (for now) above the rate of inflation. Keep socking that money away in money market mutual funds. You get a certain 5% versus an uncertain 9% in the stock market. A classic decision theory problem.

Looking ahead, if the Fed is adding liquidity, it can just as easily withdraw liquidity—after the election. If the government is spending, it can just as easily cut spending—after the election. We might get one of the biggest economic hangovers of all time—after the election, depending on the outcome.

The older I get, the less sure I am of my predictions. Not that I am afraid of putting predictions in writing—this is what I do for a living. As unstoppable as the stock market might be right now, it could all change after the election. Party on, Wayne—for now.

Jared Dillian, MFA

|

Dave Ramsey and the One-Size-Fits-All Solution

Usually, when I rank on Dave Ramsey, I get back the following: “Well, he has helped a lot of people, hasn’t he?”

Life Is Too Short to Stay in Cheap Hotels

I was in Boston last week, and usually I stay in the Seaport—the high-rent district.

The Urge to Splurge

The purpose of money is enjoyment. If you do all the basic things right, then you can splurge on yourself sometimes.