Articles Tagged: personal finance

Owning a Beater Car

There is something to be said for a beater car. And these days, buying a new car is a luxury.

Everything Is a Trade

It’s never easy to sell your favorites. You get attached—they feel like family.

What to Do If You’ve Made This Common “Mental Accounting” Mistake

Let’s talk about Mental Accounting.

How Not to Become a Rich Jerk

There are probably 50,000 books written on how to handle failure.

The Cult of Home Ownership

When I talk to young people in their late 20s, early 30s, they all say the same thing:

“I really want to buy a house.”

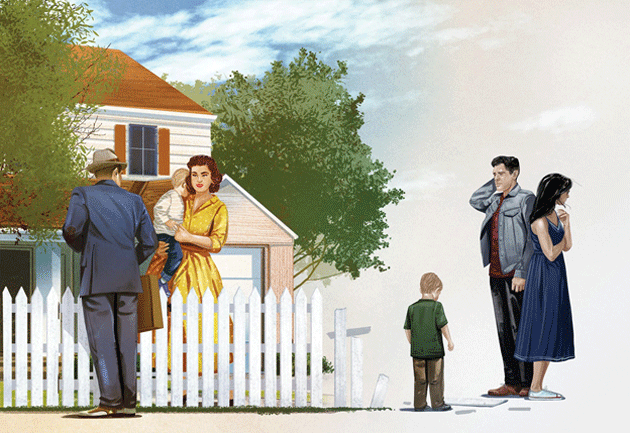

It’s the American Dream, right? A big house with a picket fence, sprawling yard, and room for a Golden Retriever.

Source: Jonathan Bartlett

Source: Jonathan Bartlett

Home ownership is programmed into our psyche.

After all, renting means you’re not an adult. (That’s the other thing people say to me, by the way: “I don't feel like an adult if I'm renting.”) You're just out here “messing around”—refusing to take the next responsible step: Buying a home. Building equity. Settling down. Blah blah blah.

Here's the thing…

You Don't Have to Own a House

The only thing you need to worry about is living within your means, and building your own wealth.

Look at it this way:

In 90% of cases, renting is cheaper.

People do the math and they say: “Here I am renting this apartment for $3,000 a month when I could just buy a house and pay $2,800 a month in mortgage costs. No-brainer, right? The house is cheaper!”

Not really.

Right now, you pay rent and utilities. If something breaks, the landlord takes care of it.

Roof leak… landlord.

Your dishwasher breaks… landlord.

Termites? Landlord.

Pipe bursts? LANDLORD.

When you buy a home, there’s no landlord to call. You are covering ALL of that on your own.

Get Ready to Pay for ALL of That

Your first home expense is a 20% down payment and closing fees. Congrats. You own a home.

Now you can tack on property taxes, insurance, escrow, and HOA fees.

Then there's the home and yard maintenance. That's equal to 1% of the value of the home each year.

That means if you have a $300,000 house, you can expect to pay $3,000 a year—or $250 a month in home maintenance.

This doesn’t even factor in “the big spends.” One day you’ll need to drop $10,000 on a new roof, or $4,000 on a new water heater.

A couple months ago, I had to drop $9,000 for a new deck. I didn’t want to spend the money, I HAD TO. It was that or fall through my deck the next time I stepped outside.

There's really not too many cases where owning a home is cheaper than renting.

It's nonsense to lock yourself into something just to feel like an adult.

If renting makes the most fiscal sense for you—then RENT.

There Are Other Ways to Build Wealth

It may sound like I’m anti-home ownership. I’m not. I own my current home, and am planning to build my dream home in the next 2 to 5 years.

I just believe that people should take the actions that lead them to the most money.

And for a lot of people, that means renting.

The money you don't spend on a down payment, broker fees, homeowner’s insurance, property tax, maintenance and repairs, landscaping, and the HOA?

Save it. Invest it.

- Home ownership is not the only path to wealth.

By the way, if you don’t know jack about investing and need to get started ASAP, then you can follow guidelines I lay out in my Awesome Portfolio to build your wealth—steadily over time.

But What if You REALLY, REALLY Want to Own Your Home?

I’ll tell you exactly what to do.

Before you make a move to buy a home—and I say this all the time—you need six months of emergency funds built up… your credit cards and other loans paid off… and you sure as hell need to be maxing out your retirement savings.

The next thing you need to do is make sure your credit score is up to snuff.

It’s 740+ or bust.

Before a real estate agent wastes any time on you, they run your credit to get an idea of how big of a loan you’ll qualify for.

Because they're going to take you shopping based on “how much house” you can afford.

This is where things get tricky.

Your agent will do this calculation based on a traditional 30-year mortgage. Why?

- They want a big commission.

- You’ll have a lower monthly mortgage cost. Which will fool you into thinking you can afford more house.

Sure, anything costs less per month if you stretch out the payment plan for 30 years.

What most people don’t think about is how much they’ll pay in interest.

You'll be paying a ton. Even if you get a good interest rate.

Obviously, this is not ideal.

So, what do you do?

- You have them run the numbers on a 15-year mortgage.

You'll pay off principal faster and pay THOUSANDS less in interest.

That means the agent will have to show you less expensive (see: more affordable) homes.

Read this too: “The ‘Secret’ to Lowering Your Mortgage Payments”

Just Because You Have It, Doesn’t Mean You Need to Spend It

Back in 2003, I bought a house for $420,000 in New Jersey. But I qualified for an $880,000 loan.

So, that's all my real estate agent wanted to show me... homes for $880,000.

I said, "That's dumb. I want to buy a cheaper house."

They did not like that.

The real estate industry is set up to get you in the most expensive house possible.

But it’s not their money. It's your money.

And as I said, YOU need to make decisions that keep you on the path to personal wealth—and to do that, you have to live within your means.

Bonus points if you can pay extra each month and shrink that balance even faster.

My point is, RENT or BUY, you need to do what makes the most fiscal sense.

You can be a 20-year-old homeowner, or a 60-year-old renter. Who cares? It all comes down to what leaves you with the most bang for your buck.

Jared Dillian

|

You Have to Get These 7 Big Money Decisions Right

A lot of people are stressed out about money.

“Screw You!” Money Is Your Key to Freedom

No, I’m not being crass. This is serious stuff. If you want to experience true financial freedom, you need to make enough money to essentially say, “Screw you!”

Master Your Personal Finances

Ritholtz Wealth Management's Ben Carlson talked about the "20 most important personal finance laws to live by" in Fortune recently.Your Credit Score Might Matter Less than You Think

You should never date anyone with a credit score below 650. But what if that person is you?