Advancing Your Career: MBA vs. CFA

When some people want to advance their careers, they get an MBA. That’s what I did—I graduated in 2001 with my MBA from the University of San Francisco. That was a good decision. It has proved valuable, and I learned a lot.

The Virtues It Takes to Make Money

Money is not the root of all evil, and the love of money is not evil. Money is good, and it’s because of the virtues that it takes to make it.

How Do You Feel About Money?

The thing about No Worries is that it is primarily a book about psychology. There is no math. There are no “10 easy steps.” There is nothing concrete to do. It is about your feelings about money and how it affects your daily life.

How we feel about money is important. The goal is to never feel anything about it! But that is impossible. I am the guy who wrote the book, and I have feelings about money. I have done the math a million times about my new house, and I still have lingering doubts about whether I can make it work. And I have a profession where I am forced to think about money all the time—I have Bloomberg up on my computer, and I am watching the prices of stocks and bonds and currencies and commodities. There is a part of me that wishes I could just go to T-bills and not think about it at all.

But a little money stress can be a good thing, which is something I did not mention in the book. We all must have a little debt at some point. We all must take risks at some point. The question is how you feel about taking on debt or risk. Does it consume you or control you? Does it motivate you or demotivate you? A life without risk is a life without return. So, we must have some stress to get ahead.

That Doesn’t Mean Unnecessary Debt or Risk

What I talk about in No Worries is the idea of unnecessary debt or risk. Running up credit card balances is dumb and counterproductive. Trading meme coins is dumb and counterproductive. You are making your life more stressful on purpose and not getting much in the way of benefit.

If you buy a house, you are taking on some debt and you are taking on some risk, but that is the good kind of debt and risk, provided that you aren’t stretching to buy the house. If you go to school to learn skills to make more money, that is a good kind of debt and risk, provided you aren’t stretching to go to school.

One thing I learned while recording a podcast with Cameron recently is that you can actually get payday loans on your phone. News to me. I mean, this is a terrible idea, but three cheers to the payday lenders for figuring out how to put payday loans in an app. That is what I call an evil genius business model. You get the triple-digit returns, without the overhead. But it served as a reminder that some people make very, very bad money decisions—still, with all the knowledge that is out there.

The Goal Is to Be Happy

I don’t know too many people taking payday loans that are happy. That is just pure misery. I don’t know too many people with sub-600 credit scores who are happy. That is just pure misery.

One of the common misconceptions about money is that you need a lot of it to be happy. You don’t! If your basic needs are met and you don’t have any debt or risk, you can be living paycheck to paycheck and be perfectly happy, as long as you have an emergency fund.

The average person in the US makes $60,000 a year. A below-average income is about $40,000 a year. $40,000 a year, by the way, is about $20 an hour. In many parts of the country, you can have an apartment, a TV, a car, appliances, and all kinds of stuff for $40,000 a year. You won’t have enough for a week-long vacation to the Greek islands, but your basic needs are met, and you have a higher standard of living than 90% of the world. So again, it is possible to have not much in the way of money and be happy.

What I’ve found is that more money tends to massively complicate your financial life and make people unhappy. First of all, your taxes get a lot more complicated. You have insurance on all kinds of things because you have nice stuff. You have tons of recurring payments. Since you have nice stuff, you have to take care of the nice stuff. A poor person doesn’t have to worry about their cat peeing on a $10,000 couch. Etc.

My goal has been to keep my financial life as uncomplicated as possible under the circumstances. For example: I do not have rental property. For sure, I could scare up another $20–30K in income off rental properties, but the work and the accounting make it not worth it.

I actually was an investor in a hedge fund for a while, but that made my life a lot more complicated. One brokerage account and one bank account are good enough for me. That’s not to say that I espouse a philosophy of financial minimalism because that is dumb. You get older, you make more money, things get more complicated—that is unavoidable.

Think about how happy you are with your financial situation—and I am not referring to the amount of money you have. What would make you happier? What would make you less happy? I can tell you what would make me happy—selling more copies of No Worries.

Jared Dillian, MFA

P.S. I recorded some new music. I named it “Higher Power.” It’s good. Check it out here.

|

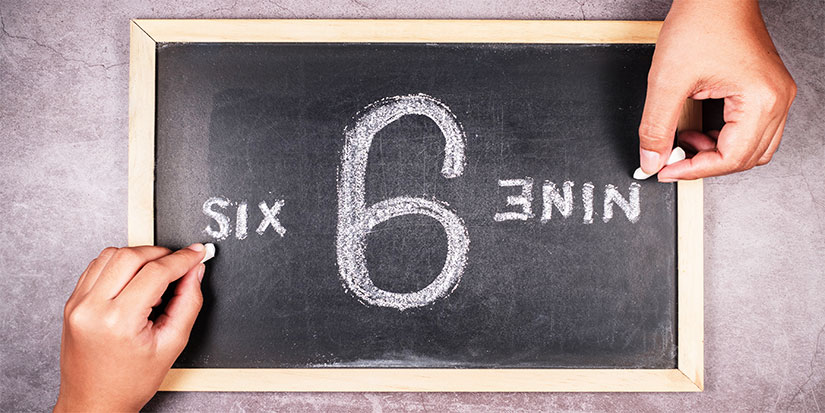

A Matter of Perspective

Things are pretty good right now. But I think most experienced market practitioners know that pain could be just around the corner.

Dave Ramsey and the One-Size-Fits-All Solution

Usually, when I rank on Dave Ramsey, I get back the following: “Well, he has helped a lot of people, hasn’t he?”

Life Is Too Short to Stay in Cheap Hotels

I was in Boston last week, and usually I stay in the Seaport—the high-rent district.