Advancing Your Career: MBA vs. CFA

When some people want to advance their careers, they get an MBA. That’s what I did—I graduated in 2001 with my MBA from the University of San Francisco. That was a good decision. It has proved valuable, and I learned a lot.

The Virtues It Takes to Make Money

Money is not the root of all evil, and the love of money is not evil. Money is good, and it’s because of the virtues that it takes to make it.

How Do You Feel About Money?

One of the common misconceptions about money is that you need a lot of it to be happy. But if your basic needs are met and you don’t have any debt or risk, you can live paycheck to paycheck and be perfectly content.

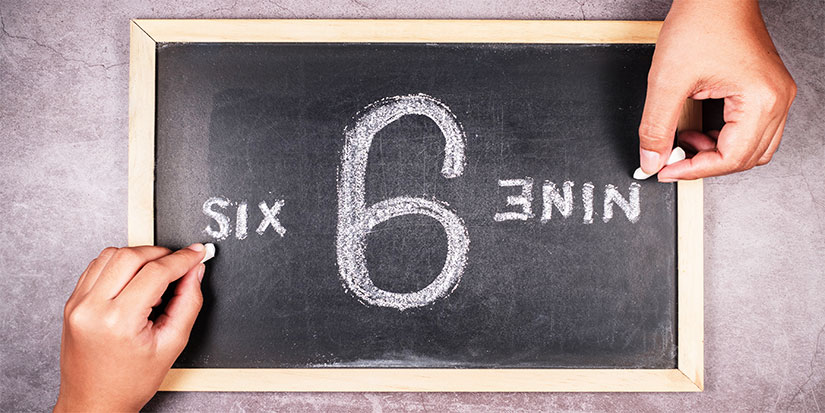

A Matter of Perspective

Things are pretty good right now. But I think most experienced market practitioners know that pain could be just around the corner.

Dave Ramsey and the One-Size-Fits-All Solution

Usually, when I rank on Dave Ramsey, I get back the following: “Well, he has helped a lot of people, hasn’t he?”

Life Is Too Short to Stay in Cheap Hotels

I was in Boston last week, and usually I stay in the Seaport—the high-rent district. There are three or four good hotels in the Seaport, typically around $300–$400 per night, which is my sweet spot for hotels at this point in my life. Anything more is superfluous.

Anyway, I sit in front of my computer about a month before the trip and start shopping for hotel rooms in the area. Nothing available. Hmm. Then I start looking elsewhere in Boston—nothing. Is there a Taylor Swift concert or something? So finally, I log in to Expedia to see what’s available, and my best option is the Sheraton in Back Bay for $180/night.

I’m not an expert on hotels, but the Sheraton is kind of a tired brand—but hey, at least I will be saving money, and at least I will be getting some Marriott Bonvoy points. With some reluctance, I reserved a room.

I arrived at the hotel last Thursday night. I walk into the lobby, and it’s big—but it looks like it hasn’t been updated since 1995. The front desk clerk is efficient and gives me the key to a room on the 15th floor. So far, so good.

I get to the room and swing open the door, and I’m greeted by the same 1995-era décor. The TV is new, but not much else, and I don’t watch TV anyway. The walls are thin—there are about five or six people next door having a small party. I look in the bathroom, which houses an old-fashioned tub with a shower curtain. The non-skid in the tub is peeling away.

I get in bed, and it’s a 3 out of 10. Not comfortable at all. Well, I was in the Coast Guard; I can sleep under any conditions, I tell myself.

Until some miscreant pulled the fire alarm at 3 am. I found myself standing outside in gym shorts in 20-degree weather, waiting for the fire department to give the “all clear.” Now I was awake, and I was unsuccessful in getting back to sleep until about 6 am.

Life is too short to stay in cheap hotels.

As I write this, I’m back home, and for some strange reason, I have this dull ache in my quads and hamstrings. I think it has something to do with the bed at the Sheraton.

So maybe I am a rich cake-eater, too good to stay in a middlebrow hotel, and that might be true. I saved myself roughly $600. I would rather have spent the $600 and stayed someplace more comfortable.

Let’s not even talk about the time that I tried to stay at the Super 8 in Frederick, Maryland, for $99 a night, and I opened the door to a puddle of urine on the floor.

Life is too short to stay in cheap hotels.

Decumulating Assets

I write you this note from the perspective of a 50-year-old man. There was a point in my life, in my 20s, when I would have put up with the peeling non-skid in the shower, and I might have even put up with the puddle of pee on the floor. You’re young, you’re trying to save money, and you’re in accumulation mode.

But then you get old, and it is time to spend that money, and a nice hotel is the perfect thing to spend it on. That is the thing about delayed gratification—some people never get to the gratification part. They’re still staying in the Red Roof, at age 65, when they’ve got a couple mil in the bank. That is madness.

I’m certainly not saying that everyone should stay at the Four Seasons. You know your financial limitations. Three nights at the Four Seasons will set you back $2,400. If you’re making $80,000 a year, that makes no sense. If you’re making $800,000 a year, you’re a daisy if you don’t. When I was getting all my tattoo work done in Atlanta over the course of a few years, I stayed at the Four Seasons. I figured I would be wrung out from all the pain, and I wanted to be comfortable. Money well spent.

And even if you’re of middling means, you should treat yourself to a nice hotel once every couple of years or so. You won’t regret it, provided you’ve met the usual stipulations about having no non-mortgage debt, an emergency fund, etc.

In my lifetime, I’ve stayed in $15 hotel rooms, and I’ve stayed in $1,500 hotel rooms. I had more sex in the $15 hotel rooms. There is a time and place for everything.

Jared Dillian, MFA

|