Windfalls

I have a rule about windfalls. Money is a tool, and it can be used for good or for ill. Don’t be a knucklehead—the money won’t last forever.

How Do You Feel About Money?

One of the common misconceptions about money is that you need a lot of it to be happy. But if your basic needs are met and you don’t have any debt or risk, you can live paycheck to paycheck and be perfectly content.

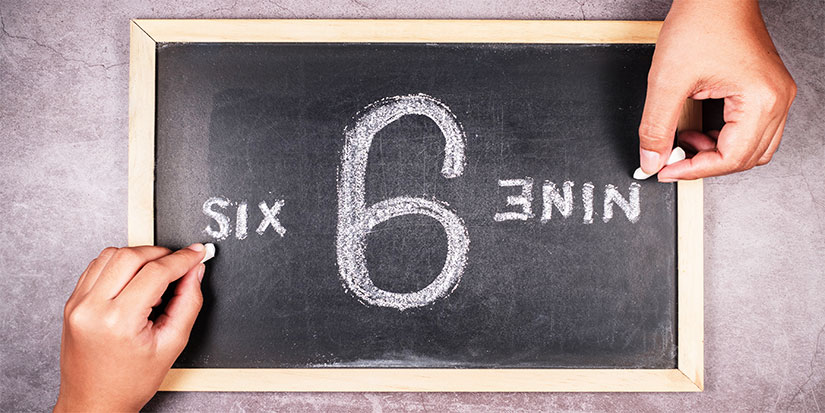

A Matter of Perspective

Things are pretty good right now. But I think most experienced market practitioners know that pain could be just around the corner.

Dave Ramsey and the One-Size-Fits-All Solution

Usually, when I rank on Dave Ramsey, I get back the following: “Well, he has helped a lot of people, hasn’t he?”

Eh. He has helped some people. He has helped the spending addicts and debt addicts gain control over their financial lives through debt abstinence. And maybe that is what addicts need: abstinence.

But that’s a one-size-fits-all solution for a lot of people who don’t need that solution. I’m not a spending addict. I don’t need to cut up all my credit cards and live off the grid. But Dave Ramsey says that we all need to cut up our credit cards and live off the grid… or something like that, which is ludicrous for 90% of the people in the US.

For those people, his prescriptions are actually harmful—they turn us all into a bunch of CFs and distort our relationship with money. And if you think about it, Dave Ramsey doesn’t really help the spending addicts either—he simply turns them into saving addicts. As you know from my book, you can spend too much, but you can also spend too little.

|

NOW ENROLLING: |

Risk and Volatility

Dave Ramsey is a knucklehead when it comes to investing. He says that you should put all your money—all of it—into growth-stock mutual funds because they return the most. Well, historically, they have returned the most, but those of us who know how markets work know that may not continue in the future.

But also, something that returns a lot probably has a lot of risk, and if you get low- to middle-income people piling into growth-stock mutual funds, they are going to experience a breathtaking amount of volatility… which will increase their stress and make them unhappy. It’s one thing to tell people they should put all their money into super-risky stuff, but if you don’t prepare them for the volatility that is about to ensue, you’re doing them a disservice.

Ramsey has also said that it is easy to beat the S&P 500, but 89% of portfolio managers would disagree.

When it comes to investing matters, Ramsey is a simpleton. Not only a simpleton but a dangerous simpleton. I’ll be candid—I really wish people would stop listening to him and start listening to me. I don’t seem to be making a lot of progress, so I’ll keep writing.

The Grocery Store Incident

A mom, a Dave Ramsey follower, goes shopping at the grocery store (true story, by the way). She has a budget for groceries, in true Dave Ramsey fashion. She goes up and down the aisles and gets her soup and toilet paper.

When she gets to the checkout, the total comes to $180, which is $30 over her $150 budget. She looks distressed. She tells the cashier, “I don’t have the money to pay for my groceries.”

But that wasn’t actually true—she had the money, but it was simply over her Dave Ramsey budget. But there was no way she was going over her budget.

So, she stood there in line until complete strangers gave her money to pay for her groceries. And she accepted those donations. Her household income? About $150,000 a year.

This is what Dave Ramsey has done to America—he has turned us into a nation of horrible CFs. Imagine being at the point in your life where you’re making six figures but will accept handouts from those of lesser means to pay for your groceries.

This isn’t the only story. There are many like it.

The No Worries Way

It’s pretty straightforward: I want to live a stress-free financial life, and I want to make a lot of money because of all the good things I can do with it. The first part of No Worries talks about making more money, which neither Dave nor any of the other personal finance experts talk about.

On TikTok, there is a hashtag trending called #DaveRamseyWouldntApprove. It’s all the Zoomers and Millennials making fun of Dave Ramsey and his crappy advice. And you know what? They are right! They intuitively know what others don’t—that you can’t live an entire lifetime of austerity, forgoing all material possessions. If you do that, you may have some money at the end, but you will be miserable.

I don’t want people to be miserable. I want them to be happy. It’s their choice.

Also, I’m not going to mix religion with personal finance, which a lot of people find distasteful. There is no reason to mix your peas and carrots. I also don’t bring a gun to work, I’m happy to say. I bring a very large Crocodile Dundee knife.

Anyway, if you’re tired of this ding-dong, you can support the cause by visiting jareddillianmoney.com, browsing our product offerings, and, if satisfied, spreading the word. Don’t reward those who preach extreme, impractical solutions. Do it the right way—the No Worries way.

Jared Dillian, MFA

P.S. Speaking of “spreading the word,” Jared Dillian Money is on the lookout for a social media intern. So, if you’re interested in helping us expand our reach, reply to this email with your resume… and let us know why you think you’d be a good fit!

|

The Coffee Debate: Urine for a Big Surprise

Common financial advice from Suze Orman and other “experts,” like avoiding daily coffee, is wrong. Focus on big financial decisions, not the little things that just don’t matter.