Windfalls

I have a rule about windfalls. Money is a tool, and it can be used for good or for ill. Don’t be a knucklehead—the money won’t last forever.

How Do You Feel About Money?

One of the common misconceptions about money is that you need a lot of it to be happy. But if your basic needs are met and you don’t have any debt or risk, you can live paycheck to paycheck and be perfectly content.

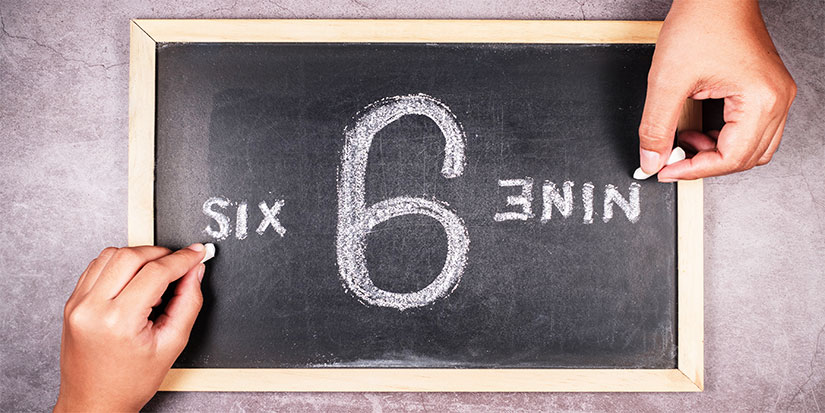

A Matter of Perspective

Things are pretty good right now. But I think most experienced market practitioners know that pain could be just around the corner.

Dave Ramsey and the One-Size-Fits-All Solution

Usually, when I rank on Dave Ramsey, I get back the following: “Well, he has helped a lot of people, hasn’t he?”

The Coffee Debate: Urine for a Big Surprise

|

Suze Orman, one of the most famous financial advisers in America, says that if you buy coffee every morning, it is like peeing a million dollars down the drain. Kevin O’Leary has had similar thoughts.

Let’s settle the coffee debate once and for all…

I buy a coffee for $3.81 just about every morning from Dunkin’ Donuts. Let’s say I buy coffee 225 days a year—that’s about $900 per year. Over 40 years, that’s $36,000. I suppose if you invested that along the way and earned some reasonable rate of return, you would have $100,000 at retirement. Maybe more, but let’s be conservative.

But you need to take into account that the coffee you make at home isn’t free either—it does cost something, so maybe that $900/year amount becomes $700/year, and you adjust your expectations down accordingly.

I don’t see where you get to that million-dollar number. The coffee you drink over an entire lifetime is probably worth $100,000 at best. And that’s assuming you invest perfectly, dollar-cost averaging into a market-cap-weighted index with no deviations.

Here is the key point: Drinking coffee makes people happy. It brings them joy. And if you ask them to economize on something that brings them joy over an entire lifetime, then they’re going to give up and go back to buying Fendi purses and blowing out their credit card bill. Any program that asks you to give up a small luxury on a daily basis is just not going to work. Not only is it not going to work, but it is going to be counterproductive. It will force you to give up on your financial future.

Buying Coffee Doesn’t Matter

Hey, I buy coffee every day, and I have lots of money. Would I have more money if I didn’t buy coffee? Perhaps marginally more. But it’s a rounding error in the grand scheme of things, and there are other things I do that have a greater impact on my wealth—like my work, writing books, writing this newsletter, running this company, and all that stuff.

Where you work has a greater impact on your financial well-being than coffee. Whether you get stock options has a greater impact on your financial well-being than coffee. How many kids you have has a greater impact on your financial well-being than coffee. What you pay for college has a greater impact on your financial well-being than coffee. The coffee is peewee BS that just does not matter, and you have these so-called financial “experts” focused on BS that just does not matter, alienating everyone in the process.

Wouldn’t it be nice to have a financial expert who is not a complete ding-dong dispensing advice? Well, that is why you are reading this letter… because you trust that I have perspective and maturity about these sorts of things.

Suze Orman has made a lot more money than I have selling preposterously bad ideas. I’m just saying the best ideas don’t always win, but slick marketing does. We have some good marketing people at Jared Dillian Money, but it’s a process. Really, we are relying on you to spread the word.

So, if you think the whole coffee debate is a bunch of nonsense, forward this newsletter to someone who agrees, and have them sign up. This debate is completely unproductive and useless. Good for headlines on Yahoo! Finance but little else.

Stop Focusing on the Little Things!

I’ll tell you something else that I do that is going to grind Suze Orman’s gears. I go out to lunch pretty much every workday, which comes out to about $20/day. That’s about $4,000 a year, after factoring in vacations and such. That’s even more than the coffee, but again, it’s a rounding error in the context of the work that I do.

Now, I’ve tried bringing lunch to work. I put together a salad in a Tupperware container, and I have a bottle of Newman’s Own on my desk, and I eat this miserable salad at my desk and contemplate my miserable existence. And then I will spend nine hours in my office, uninterrupted, without ever leaving. Going out to lunch brings me joy. It is worth the $4,000. If you make $100,000, you can afford to go out to lunch.

The little things are the little things. The big things are the big things. The little things are not the big things. STOP FOCUSING ON THE LITTLE THINGS THAT DON’T MATTER.

I know how many people are subscribed to this newsletter, and I know how many books I have sold. A lot of you still need to buy the book. Don’t tell me you’re getting cheap about $28. If so, then you’re the target audience.

Jared Dillian, MFA

|